March 14, 2014

It’s always entertaining when people who obviously have no clue about the basic facts on Social Security take to educating people on Social Security. Of course it’s unfortunate when such people actually get taken seriously. In the hope of reducing this risk, BTP takes this opportunity to address Abby Huntsman’s warning to millennials about the risks posed to them by Social Security.

Ms. Huntsman (the daughter of unsuccessful presidential candidate Jon Huntsman) tells her audience that the problem is that people are living much longer so that we are seeing much higher ratios of retirees to workers than when the program was first established in 1937. There are two big problems with the basics of Huntsman’s story. First, most of the gain in life expectancy that she points to in the segment is the result of reduced infant mortality, not people living longer. For example, the Social Security trustees report shows life expectancy at birth increased by more than 15 years from 1940 to 2012, however life expectancy at age 65 has increased by just 6.5 years. It’s great to see lower infant mortality rates, but this doesn’t affect the finances of Social Security, it is the increase in life expectancy at age 65 that matters.

However the bigger problem with Huntsman’s diatribe is that this increase in life expectancy was expected at the time the program was created. As a result, a number of increases in the tax rate were put into place in the next five decades. The initial tax rate was just 2.0 percent of wages on both the worker and the employer. Since 1990 it has been 6.2 percent of wages for both employer and employee. (The taxable wage base was also increased substantially.) These increases were put in place to deal with the costs associated with a rise in the ratio of retirees to workers. The age for receiving full benefits has also been increased from 65 to 66 at present, and will rise to 67 for people reaching age 62 after 2022. It is flat-out wrong to claim either that the increase in life expectancy caught anyone by surprise or that no changes were made to deal with longer life expectancies.

The other part of Huntsman story that is even more misleading is the idea that the finances of the program poses some insoluble problem or that the program will impose an unbearable burden on millenials. In fact, average wages are projected to grow substantially in coming decades. If most millenials get their share of wage growth, then they will enjoy far higher standards of living than do workers today, even if their taxes are increased to cover the cost of a larger number of retirees.

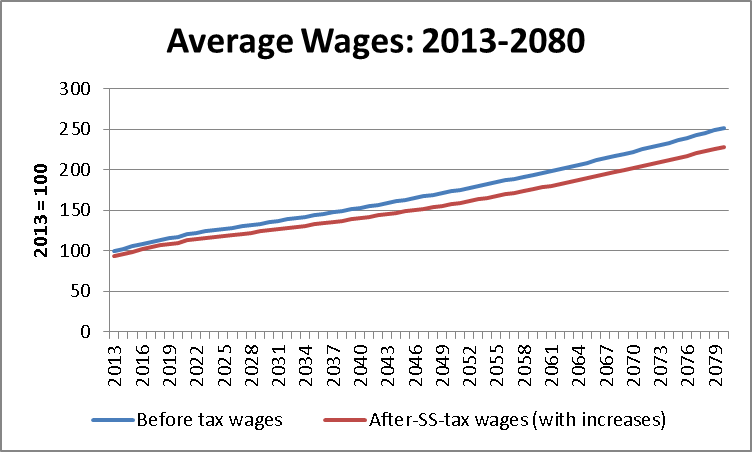

The figure below shows the Social Security trustess projections for wages over the next seven decades. It also shows after Social Security tax wages under the assumption that taxes are increased at the rate 0.05 percentage points on both workers and employers each year from 2020 to 2050. This increase will be enough to leave the program fully funded well into the next century even assuming no other changes are ever made.

Source: Social Security Trustees Report and author’s calculations.

Of course there is a big problem wiith this story. In the last three decades most workers have not shared in the growth of the economy. Most of the gains have gone to profits or highly paid workers like Wall Street traders, CEOs, and some celebrity types like Ms. Huntsman. If this pattern continues then millenials may not see rising living standards in the decades ahead. However, the risk to living standards posed by the continuing upward redistribution swamps any risks posed by a larger population of retirees. It is understandable that those who benefit from the upward redististribution would prefer to have public attention focused on Social Security, but this focus is not based in economic reality.

Correction:

Mike Anderson has pointed out that the tax increase specified in this post would not be enough to produce a balance over the trust fund’s 75-year planning horizon. In order to get to balance with a tax increase phased in over 30 years, beginning in 2020, it would be necessary to have a tax increase of roughly 0.22 percentage points annually (0.11 percentage points on both the employee and employer). This implies a cumulative tax increase of 6.6 percentage points by 2050, slightly larger than the 6.4 percentage point increase in the payroll tax between 1960 and 1990. This calculation assumes no reduction in scheduled benefits, no increase in the retirement age, and no increase in the cap on taxable income. It also assumes no further tax increases in years after 2050. Under this schedule real after-Social Security tax compensation would be on average almost 50 percent higher in 2050 than it is today. By 2060 it would be more than 60 percent higher.

It is also worth noting that these calculations assume some further upward redistribution of income. If some of the upward redistribution of the last three decades were reversed, the tax increases needed to balance the trust fund would be smaller.

Second Correction:

Sorry folks, sometimes you need a little sleep to see your spreadsheet clearly. Anyhow, having checked again, it looks like I was much closer to the mark the first time. An increase in the tax rate of 0.14 percentage points annually (0.07 percent on both the worker and the employer) begginning in 2020 and running for thirty years should be sufficient to make the trust fund balanced for its 75 year planning horizon. This leaves a total increase in the tax rate of 4.25 percentage points (2.23 on both the worker and the employer) by 2050. (The spreadsheet is available on request.)

Comments