January 12, 2018

January 12, 2018 (Prices Byte)

By Dean Baker

Prices in most sectors, however, are contained

A 0.4 percent rise in the shelter index pushed the rate of inflation in the core CPI to 0.3 percent in December, its largest increase since a similar 0.3 percent rise in January. The overall CPI rose by just 0.1 percent last month, bringing its increase over the last year to 2.1 percent. The core CPI has increased by 1.8 percent over the year. The annualized rate in the core index comparing the average price index of the last three months (October, November, and December) with the prior three months (July, August, September) is 2.3 percent.

The extent to which the core inflation is driven by shelter is striking. The core index, excluding shelter, rose 0.2 percent in December and is up by just 0.7 percent over the last year.

The sharp run-ups in rent continue to be overwhelmingly a story for the South and West, as rent increases have been relatively modest over the last year in most cities in the East and Midwest. Owners’ equivalent rent (OER) has risen by just 2.1 percent in the New York metropolitan area over the last year, down from a 2.9 percent increase in the prior 12 months. (OER is a better measure of pure rents, since it excludes utilities that are often included in the rent proper index.)

Over the last year OER rose by 1.6 percent and 2.6 percent in Philadelphia and Boston, respectively. OER rose by 2.1 percent in Chicago and just 0.7 percent in St. Louis.

By contrast, OER rose 6.5 percent over the last year in Dallas, 4.6 percent in Miami, and 5.5 percent in Tampa. In the West, OER rose by 5.0 percent in Denver, 4.4 percent in Los Angeles, 7.1 percent in Portland, and 6.3 percent in Seattle. In short, insofar as we are seeing any inflationary pressure at all, it is coming from rapidly rising rents in a relatively small number of cities. Rent increases are well-contained in most parts of the country.

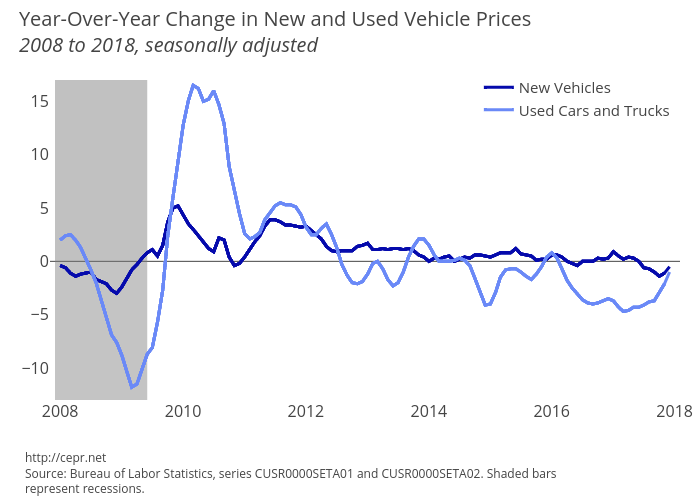

Apart from rents, prices in most sectors are well-contained. An exception is vehicle prices, where used car prices rose by 1.4 percent in December and new car prices rose by 0.6 percent. The summer hurricanes are likely a major part of this story. Hundreds of thousands of cars were destroyed, mostly by flooding in the Houston area. As a result, used car prices have risen for three consecutive months after declining for the first nine months of the year. Higher used car prices also have led to higher new car prices. However, even with the recent rise, used and new car prices are still down by 1.0 percent and 0.5 percent, respectively over the last year. Car insurance also continues to far outpace the overall CPI, rising by 0.6 percent in December and 7.9 percent over the last year.

Inflation in other areas remains low. The price of medical care services rose 0.2 percent in December and is up 1.6 percent over the last year. Prescription drug prices rose 1.0 percent in December, but are still up by only 2.8 percent for the last year. College tuition rose 0.2 percent and is up by 2.1 percent over the last year. Apparel prices continued to fall, declining 0.5 percent, which brings their fall over the last year to 1.6 percent. Airfares continued to fall in spite of the rise in the price of fuel, dropping 0.5 percent in December and 4.0 percent over the last year.

Prices also seem well-contained at earlier stages of production. The overall final demand index fell by 0.1 percent in December, while the core index rose by 0.1 percent. Over the last 12 months the overall index is up by 2.6 percent, while the core index is up by 2.3 percent. Both figures are small declines compared with the November year-over-year increase.