July 09, 2012

Robert Samuelson decided to blame the 60s again for the economic problems that we are suffering today. He argues that the decision by Kennedy to deliberately run higher deficits to boost the economy and to tolerate a higher rate of inflation gave us all of our current headaches. The former because we ended up with so much debt that we can’t now use large deficits to boost demand and the latter because it led to the runaway inflation of the 70s. It’s easy to show that both contentions are wrong.

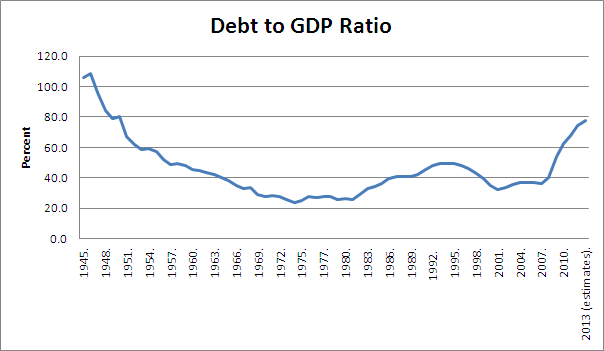

First, the decision by Kennedy to run larger deficits did not lead to an increase in our debt to GDP ratio. In fact, this continued to decline through the 60s and 70s. The rise in the debt to GDP ratio was a Reagan era innovation. The ratio actually fell in the Clinton years, so for those keeping score on such things, rising debt to GDP ratios is largely a post-Reagan Republican president story.

Source: Economic Report of the President.

The second part of Samuelson’s argument is also wrong. There are relatively few instances where wealthy countries have seen large debt to GDP ratios. The claim that ratios above 90 percent slow growth confuses cause and effect. For example, Japan had a very low debt to GDP ratio before its stock and real estate bubbles burst in 1990. This collapse gave them both slow growth and a high debt to GDP ratio.

At the most basic level, the logic here is faulty. Government debt is an arbitrary category. If a government sold off assets or the right to tax (e.g. parking meters or patent monopolies) it can reduce its debt to GDP ratios in ways that could not plausibly increase growth. For this reason the idea that there is some systemic relationship between debt and growth is ridiculous on its face.

Finally, Samuelson’s complaint on inflation is badly mistaken. The United States would have benefitted enormously if it had a higher rate of inflation at the start of the downturn. If the underlying inflation rate had been 4.0 percent rather than 2.0 percent at the start of the downturn, a Federal Funds rate of zero would imply a negative real interest rate of -4.0 percent rather than -2.0 percent. This would have allowed monetary policy to provide a substantially larger boost to the economy.

Comments