June 20, 2016

Last month the International U.S. Trade Commission (ITC) came out with its assessment of the Trans-Pacific Partnership (TPP). It projected that in 2032, when the economy will have experienced most of the effects of the deal, income will be 0.23 percent higher than in a baseline without the TPP. This translates to an increase in the annual growth rate of 0.014 percentage point.

That is not the sort of thing that would likely get most people too excited. It means that with the TPP in place we will basically be as rich on January 1, 2032 as we would be in the middle of February of 2032 without the TPP. Still this is better than nothing, so why not take the gains the ITC is projecting?

The answer to that question is that the ITC projections are hardly a sure deal. Its past track record, like that of most modelers of trade agreements, has been pretty dismal. The actual patterns in trade have born essentially no relationship to the projected patterns.

This may be due to the possibility that the impact of factors not included in the models swamped the projected impact of the changes being modeled. That’s an argument that can save the validity of the models used by the ITC and other economists, but doesn’t change the fact that these models have not been useful guides to the future course of trade and economic growth.

It is easy to envision scenarios in which the loss of jobs and output resulting from a rise in the U.S. trade deficit following the implementation of the TPP, swamp the sort of gains projected by the ITC and other modelers. It is also possible to envision scenarios in which the TPP provisions not included in the ITC model have a larger impact in slowing growth than gains projected from the reduction in trade barriers included in the model. For example, the impact of higher prices for drugs and other items subject to stronger patent and copyright protection could well exceed the gains from lowering barriers that were in almost all cases already very low.

But it is useful to first get a perspective on how important the projected gains from the TPP are relative to other policies. The Federal Reserve Board’s policy on interest rates provides a useful basis of comparison. There is currently a major debate both inside the Fed, and in economic policy circles more generally, as to whether the Fed should be trying to slow growth or instead should be looking to speed up the pace of recovery.

The issue is whether the labor market is getting so tight that it will begin to set the economy off on an inflationary spiral. The Fed is looking at the unemployment rate and other measures of the labor market’s strength to determine when it should again raise interest rates to slow the rate of job creation.

We can’t know with certainty how low the unemployment rate can go before inflation becomes a serious problem, but we can say how much it costs to err on the side of too much unemployment. Okun’s Law equates a 1.0 percentage point drop in the unemployment rate with a 2.0 percentage point rise in GDP.

This means that if we want to see the unemployment rate drop by 1.0 percentage point over the next year, we would need GDP to grow 2.0 points more rapidly than in the baseline case where unemployment remains constant. In the current economy, this would mean GDP growth of around 4.0 percent rather than the 2.0 percent growth rate currently forecast for the year. This relationship allows us to approximate how much GDP we would forego if the Fed erred by keeping the unemployment rate higher than necessary.

For example, if it erred by a half percentage point, keeping the unemployment rate at 4.7 percent when it could actually fall to 4.2 percent without triggering inflation, the cost would be a full percentage point of GDP. This loss would be felt every year that the unemployment rate was at 4.7 percent.

In fact, the size of the annual loss (measured as a share of GDP) would actually increase through time. The reason is that with lower GDP we would see less investment. Investment is roughly 13 percent of GDP. As a first approximation, it is reasonable to assume that if the Fed’s error lowered GDP by 1.0 percentage point, then it would reduce investment by an amount equal to 0.13 percent of GDP.

Lower investment matters, because with less capital, the economy would be less productive than would otherwise be the case. Reducing investment by 0.13 percent of GDP may not matter much for one year, but over time this can have a substantial impact on reducing growth, adding to the loss of 1.0 percent of GDP directly associated with the lower level of employment.

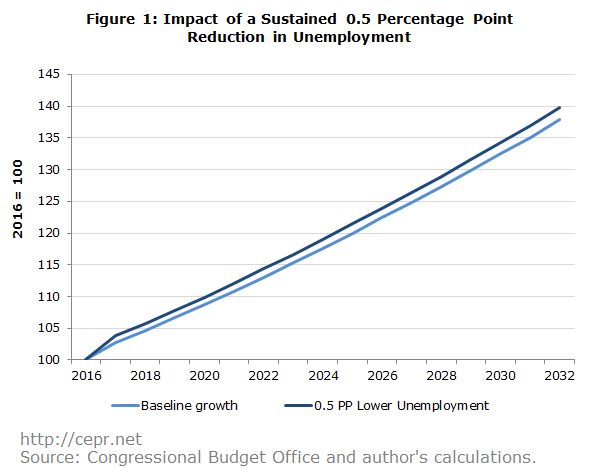

This is shown in Figure 1. The gain from a 0.5 percentage point reduction in the unemployment rate rises from 1.0 percent of output in 2017 to more than 1.4 percent by 2032.1

It is worth noting that Figure 1 shows a very conservative estimate of the potential gains from lower rates of unemployment. It does not include any long-term gains associated with pulling more people into the labor force. The Congressional Budget Office and other forecasters have hugely reduced their projections of potential GDP under the assumption that many of the people who lost jobs in the downturn have permanently left the labor market. While these projections may prove to be incorrect (people may return to the labor market if there is demand for their work), if the logic is correct, by sustaining higher levels of employment, the Fed will be keeping more people in the labor market and thereby increasing potential GDP. The size of this effect could easily exceed the impact of more investment in raising potential output.

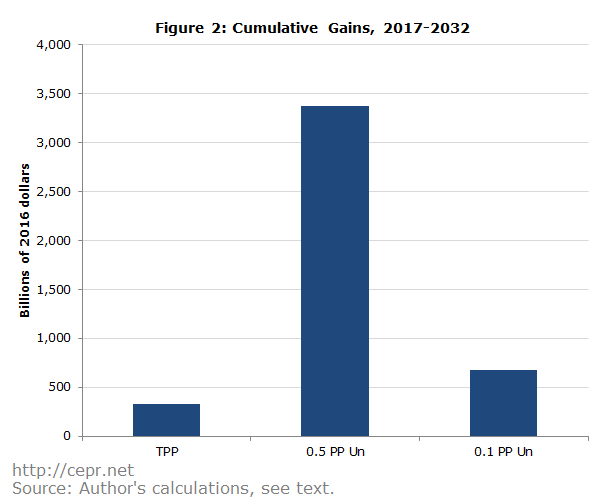

To get an assessment of the importance of the potential gains from lower unemployment relative to the gains from the TPP, Figure 2 sums the gains from 0.5 percentage point reduction in the unemployment rate, sustained over the next 16 years, and compares it to the ITC projections of the gains from the TPP.

Following the ITC projections, it is assumed that the gain of 0.23 percentage points by 2032 is phased in over the next sixteen years at a rate of 0.014 percentage points annually. The future gains from the TPP and a reduction in the unemployment rate are both discounted at a 2.7 percent real rate.

As can be seen, the gains from sustaining an unemployment rate that is 0.5 percentage points lower than the baseline are more than an order of magnitude larger than the ITC’s projections of gains from the TPP. Over the next decade, a sustained 0.5 percentage point reduction in the unemployment rate, relative to the baseline, would lead to a cumulative gain of 3.37 trillion dollars. By contrast, the ITC projection implies that the gain from the TPP over this period would be $331 billion. Clearly there is far more to be gained if we can sustain a lower level of unemployment than we can possibly hope to gain from the TPP.

To make this point even more clearly, Figure 2 also shows the cumulative gain from 2017 to 2032 of sustaining an unemployment rate that is just 0.1 percentage point below the baseline. This would be $674 billion, more than twice the projected gain from the TPP. These simple calculations suggest that there is much more to be gained by trying to push the unemployment rate as low as possible than anything we can hope to get by way of economic growth from the TPP.

1 This calculation assumes that the capital output ratio is 1.6. It also assumes that the coefficient on capital in a Cobb-Douglas production function is 0.33. This means that the increase in output in the following year due to higher investment is equal to roughly 0.025 percent of the increase in GDP.