December 11, 2015

Last week, CEPR released a report titled The Anomaly of U-3: Why the Unemployment Rate is Overstating the Strength of Today’s Labor Market. The report shows that the U-3 unemployment rate, also called the official unemployment rate, is out of line with eleven alternative measures of labor market slack.

Five of these measures — the U-1, U-2, U-4, U-5, and U-6 unemployment rates — are calculated at the state level. These five alternative measures allow us to examine the strength of each state’s job market. By all but one measure, the U-3 unemployment rate is overstating the strength of the economy in a clear majority of states. This can be seen in Table 1 below, which summarizes the results from Tables 2-7.

One problem with the figures produced by the Bureau of Labor Statistics (BLS) is that they round each unemployment rate to the nearest one-tenth of a percentage point. This means that an unemployment rate of 5.6 percent doesn’t necessarily represent 5.60 percent unemployment; rather, it represents a rate somewhere between 5.55 and 5.65 percent. This presents two problems for our analysis. First, it affects the calculations of the predicted U-3 unemployment rate. For example, a U-4 unemployment rate of 5.75 percent would typically correlate with a U-3 unemployment rate of 5.50 percent; a U-4 unemployment rate of 5.85 percent would correlate with a U-3 rate of 5.59 percent. If the U-4 rate were rounded to 5.8 percent, then our predicted U-3 unemployment rate of 5.55 percent could be off by between -0.05 and +0.04 percentage points. For the five alternative measures more broadly, the predicted U-3 rate could be off by as much as +/- 0.05 percentage points.[i] Second, the U-3 unemployment rate itself is rounded to the nearest tenth of a percentage point. This means that the exact U-3 rate could be 0.05 percentage points higher or lower than the rate published by the BLS. When combined, these two problems mean that rounding errors can contribute up to +/- 0.10 percentage points to the estimated gap between the actual U-3 unemployment rate and the predicted U-3 rate.

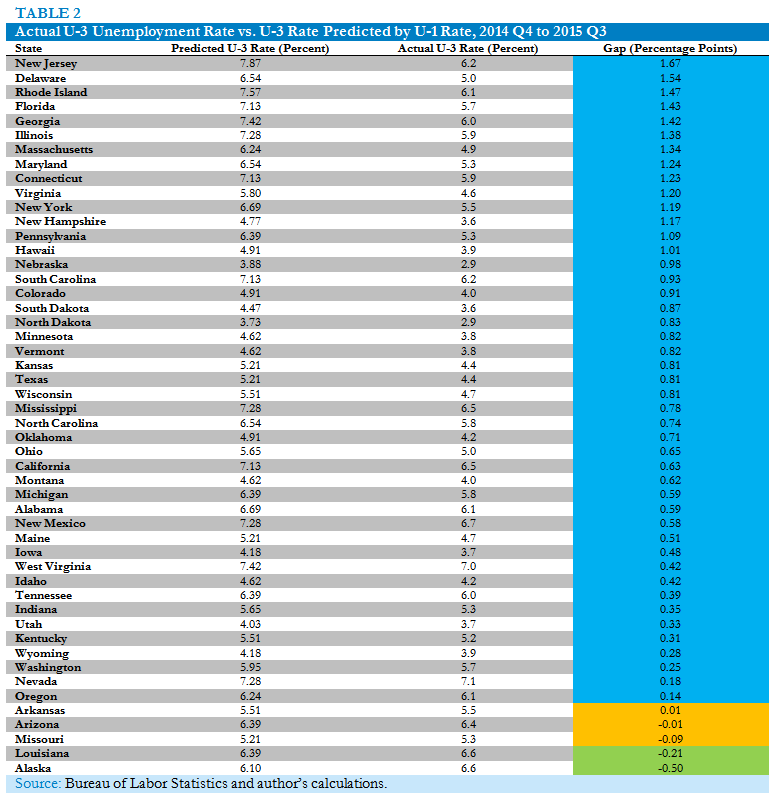

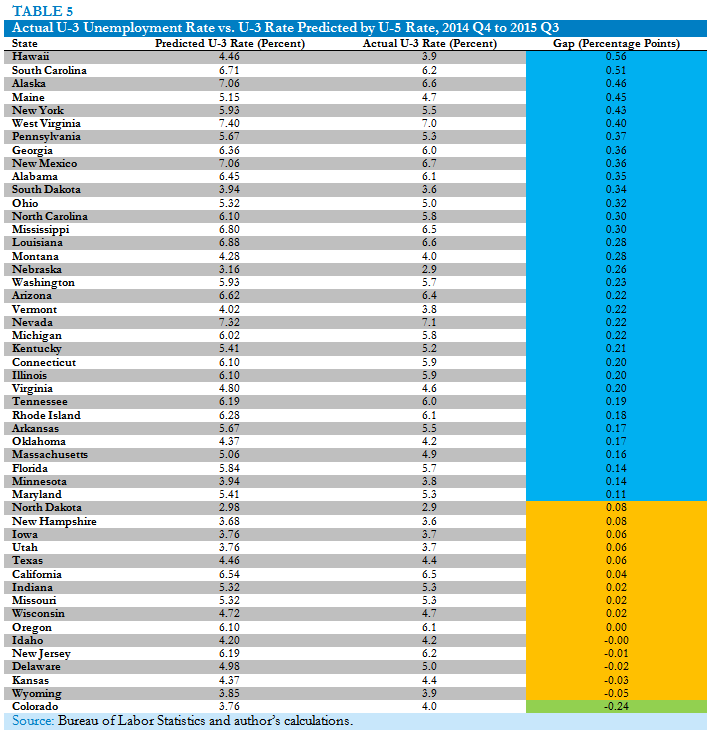

In Tables 2-7, the second column shows what we would expect the U-3 unemployment rate to be given the specified alternative unemployment rate. The third column shows the actual U-3 unemployment rate. The last column shows the percentage-point discrepancy between the predicted U-3 rate and the actual U-3 rate. If the predicted rate is higher than the actual rate, the cell in the last column is highlighted in blue; if the predicted rate is lower than the actual rate, it is highlighted in green; and if the predicted rate is less than 0.10 percentage points higher or lower than the actual rate, the cell is highlighted in orange. The states are listed in order from the largest positive gap to the largest negative gap. Preceding each table is a description of the given unemployment rate.

The U-1 unemployment rate serves as a measure of long-term unemployment. It estimates the percentage of the civilian labor force that has been unemployed 15 weeks or longer. Overall, 45 out of 50 states have a higher U-1 rate — and thus a higher rate of long-term unemployment – than we would expect given the state’s U-3 unemployment rate. This is shown in Table 2 below.

The U-2 unemployment rate limits its definition of unemployment to workers who have been laid off. Workers who quit their jobs, begin looking for work after a leave of absence from the labor market, or start searching for their first job are not counted as unemployed in the U-2 measure. The U-2 unemployment rate therefore serves as a proxy for the reasons why workers slip into unemployment. In the aforementioned paper, the U-2 rate was the only alternative measure which showed that the national U-3 rate should be lower for any given month of 2015. Through the first six months of the year, the U-2 rate indicated that the U-3 rate should be slightly lower; this finding reversed itself later in the year, and over the last four months the U-2 rate has predicted that the U-3 rate should be slightly higher. This is consistent with the findings presented in Table 3, which shows that the U-2 rate is higher than we’d expect in 23 states and lower than we’d expect in 22 states.

The U-4 unemployment rate takes the U-3 rate and adds in “discouraged workers.” These are prospective workers who have searched for employment in the last 12 months, but haven’t searched within the past four weeks specifically for the reason that they didn’t think any jobs were available. Discouraged workers must want a job and be available to work. If the actual U-3 rate is lower than the U-3 rate predicted by the U-4 rate, then the given state has far more discouraged workers than we should expect. This appears to be the case in 30 states. Notably, not a single state has a U-3 rate higher than we’d predict based on the U-4 rate, as the remaining 20 states have U-3 rates that are within 0.10 percentage points of what we’d expect.

The U-5 unemployment rate takes the U-3 rate and adds in “marginally attached workers.” Like discouraged workers, marginally attached workers have searched for a job within the past 12 months but not the past four weeks. However, they can give any reason for having dropped their search for work. (Discouraged workers are a subset of marginally attached workers.) Marginally attached workers must desire a job and be available to work immediately. Overall, the various U-5 unemployment rates indicate that the U-3 unemployment rate should be higher in 34 states and lower in 1 state. When combined with the results from the U-4 rate, the findings presented in Table 5 are telling: the U-3 unemployment rate is low not because the labor market has been good at providing workers with jobs, but rather because many prospective workers have given up the search for work. In most states there are far more discouraged and/or marginally attached workers than we’d normally expect given the states’ U-3 unemployment rates.

The U-6 unemployment rate is the same as the U-5 unemployment rate except that it counts involuntary part-time workers as unemployed. “Involuntary part-time workers” are those who would like a full-time job but are working less than 35 hours per week. The previously referenced paper concluded that there is an unusually high incidence of involuntary part-time employment in today’s economy. This is consistent with the findings presented in Table 6, which shows that according to the U-6 measure, the U-3 rate is overstating economic strength in 48 out of 50 states.

Finally, it’s worth asking what the five alternative unemployment measures demonstrate in their totality. That is, if we know a state’s U-1, U-2, U-4, U-5, and U-6 unemployment rates, what would we expect its U-3 rate to be? We can perform this calculation by taking an average of the five U-3 rates predicted by each of the alternative measures. This has been done in Table 7 below; overall, it appears that the U-3 rate is understating the weakness of the economy in 46 states.

This result is hardly surprising. In Tables 2-6, not even one state had three or more alternative measures imply that the U-3 rate should be lower. Furthermore, only three states had a measure other than the U-2 rate signal that the U-3 rate should be lower.[ii]

In most states, there are far more discouraged workers, marginally attached workers, involuntary part-time workers, and long-term unemployed workers than we would expect given the state’s unemployment rate. There is good reason to believe that the U-3 unemployment rate is understating the weakness of the economy in nearly every state.

[i] Technically, this differs slightly by unemployment rate. For the U-1 and U-2 measures, the predicted U-3 rate could be off by as much as 0.07 percentage points; for the U-4 measure, it could be off by 0.05 percentage points; for the U-5 measure, 0.04 percentage points; and for the U-6 measure, 0.03 percentage points. However, in order to be consistent across measures, an average (0.05 percentage points) of the five possible errors was used instead.

[ii] The full breakdown: 27 states had zero measures signal that the U-3 rate should be lower; 20 states’ U-2 rates signaled that the U-3 rate should be lower; Colorado’s U-5 rate signaled that its U-3 rate should be lower; and Alaska and Louisiana’s U-1 and U-2 rates both signaled that the U-3 rate should be lower.