November 13, 2016

The NYT had an interesting piece that focused on the Carrier air conditioner factory in Indianapolis, Indiana that the company is closing and moving to Mexico. The piece describes the impact on the city and the people who work in the factory, many of whom apparently voted for Donald Trump in the hope that he would save their jobs.

One item in the story is somewhat misleading. The piece presents the views of John Van Reenen, an economist at M.I.T.:

“‘These are fundamental forces that have more to do with technology than trade.’

In particular, he said, across developed economies more national income is going to capital, that is, owners and shareholders, rather than labor. ‘We’ve seen this in many countries with different political systems,’ he said. ‘It’s a winner-take-all world.'”

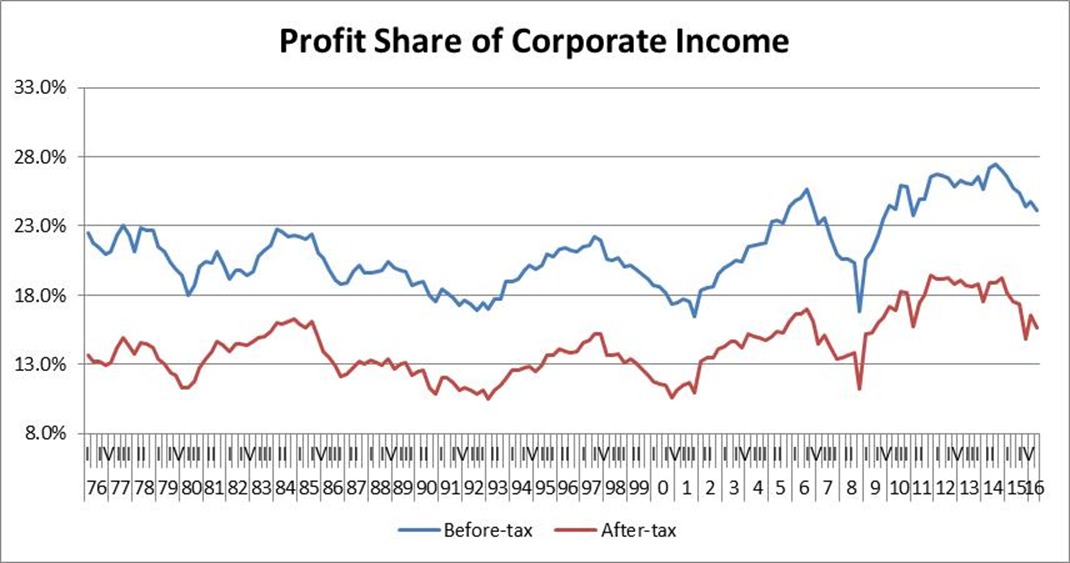

There are two important qualifications that should be made to these comments. First, while there was a substantial shift of income from labor to capital in most wealthy countries in the the last four decades, that was not really the case in the United States. While there were cyclical ups and downs, there was little change in the capital share of corporate income until 2005, as shown below.

Source: Bureau of Economic Analysis and author’s calculations.

This is worth noting since the bulk of the upward redistribution had already been accomplished by 2005. The implication is that the upward redistribution was not due to firms getting more profits are the expense of workers in general, but rather higher paid workers benefiting at the expense of less-highly paid workers.

In the context of the trade story discussed here, this means that the lower cost of labor from outsourcing jobs to other countries was largely passed on to consumers in lower prices. While the workers who lost jobs and/or were forced to take pay cuts are hurt in this story (essentially the portion of the work force without college degrees), high end workers like CEOs and Wall Street types benefit. Also professionals like doctors, who benefit from protectionist restrictions (foreign doctors are prohibited from practicing in the United States unless they complete a U.S. residency program), benefit as well. This policy of selective protectionism had the predicted and actual effect of redistributing income upward.

The shift of income to profits since 2005 is likely in large part a result of the weakness in the labor market following the collapse of the housing bubble and the resulting recession. It appears that the labor share is again recovering, but whether it actually gets back to its pre-recession (and pre-2005) level will depend in large part on whether the labor market is allowed to tighten further or the Fed prevents further tightening by hiking interest rates.

The other qualification to Van Reenen’s comments is that technology does not by itself determine distribution. The claims to ownership of technology (i.e. patent protection, copyright protection, and related forms of intellectual property claims) are what determine distribution. In the past four decades, Congress has implemented numerous measures both nationally and internationally through trade agreements that had the explicit purpose of making these protections stronger and longer. So the resulting upward redistribution cannot be attributed simply to “technology,” rather it was the result of policy decisions that were intended for this purpose.

Comments