December 16, 2014

Economies typically grow and that means aggregate wage income typically grows. That is why it is a bit bizarre that in laying out the case for a Fed rate hike, Steve Mufson told readers:

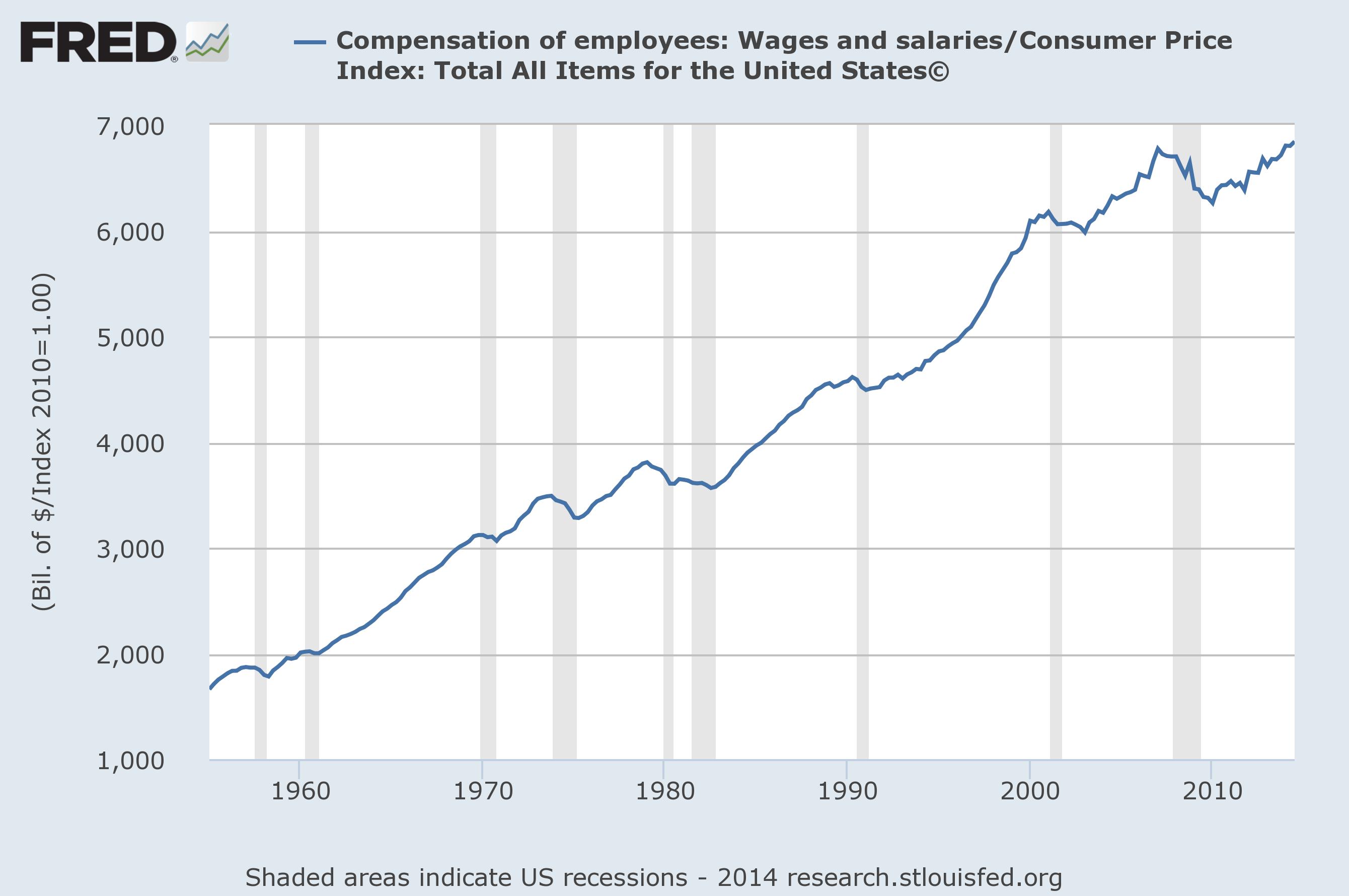

“Inflation-adjusted wages and salaries in personal income rose to a record high during October, up 2.9 percent from the year before.”

That’s pretty much the normal state of affairs, as can be seen.

The Great Recession was extraordinary in giving us a prolonged period in which inflation-adjusted wages did not grow. The fact that we have finally passed the 2007 level is not much of a case for raising interest rates, which just to be clear, means slowing growth and killing jobs.

On this last point the piece includes a mistaken comment from Gregory Mankiw. He is quoted as saying that the percentage of workers who are willing to quit their jobs without having another job lined up is “looking much closer to normal levels.” This is not true. The percentage of unemployment due to people who had voluntarily quit their jobs was 9.1 percent in November. This is above the recession low of 5.5 percent, but it is well below the 11-12 percent range of 2006-2007 and far below the 13-14 percent levels of the late 1990s and 2000, the last time workers saw real wage growth.

Comments