•Press Release Global Debt Crisis IMF IMF Surcharges Special Drawing Rights

Washington, DC — As the International Monetary Fund (IMF) prepares to meet this week to decide on possible reforms to its surcharge policy, a new post from the Center for Economic and Policy Research examines scenarios for various reforms and the implications for borrowing countries. Recent media reports have noted that several variables are being considered during the Fund’s current review of surcharge policy, including surcharge rates, the threshold for imposing surcharges, and the Fund’s basic rate of lending. The post, by Senior Research Fellow Andrés Arauz and Research Associate Ivana Vasic-Lalovic, concludes that eliminating surcharges entirely and reducing the lending margin would be the best option, while the next best path forward would be a combination of an increase in the surcharge threshold, a reduction of the time-based and level-based surcharge rates, and reducing the lending margin of the basic rate to 50 basis points. Since the IMF has had a record net income in the last year, the authors conclude that it can afford either option.

“The IMF should act now and enact reforms to a policy that is compounding the challenges faced by a growing number of countries in debt distress,” Andrés Arauz said. “The Fund has had record levels of income over the past year; it met its target for precautionary balances earlier this year, and there are really no more excuses. It should stop siphoning money away from countries that urgently need it.”

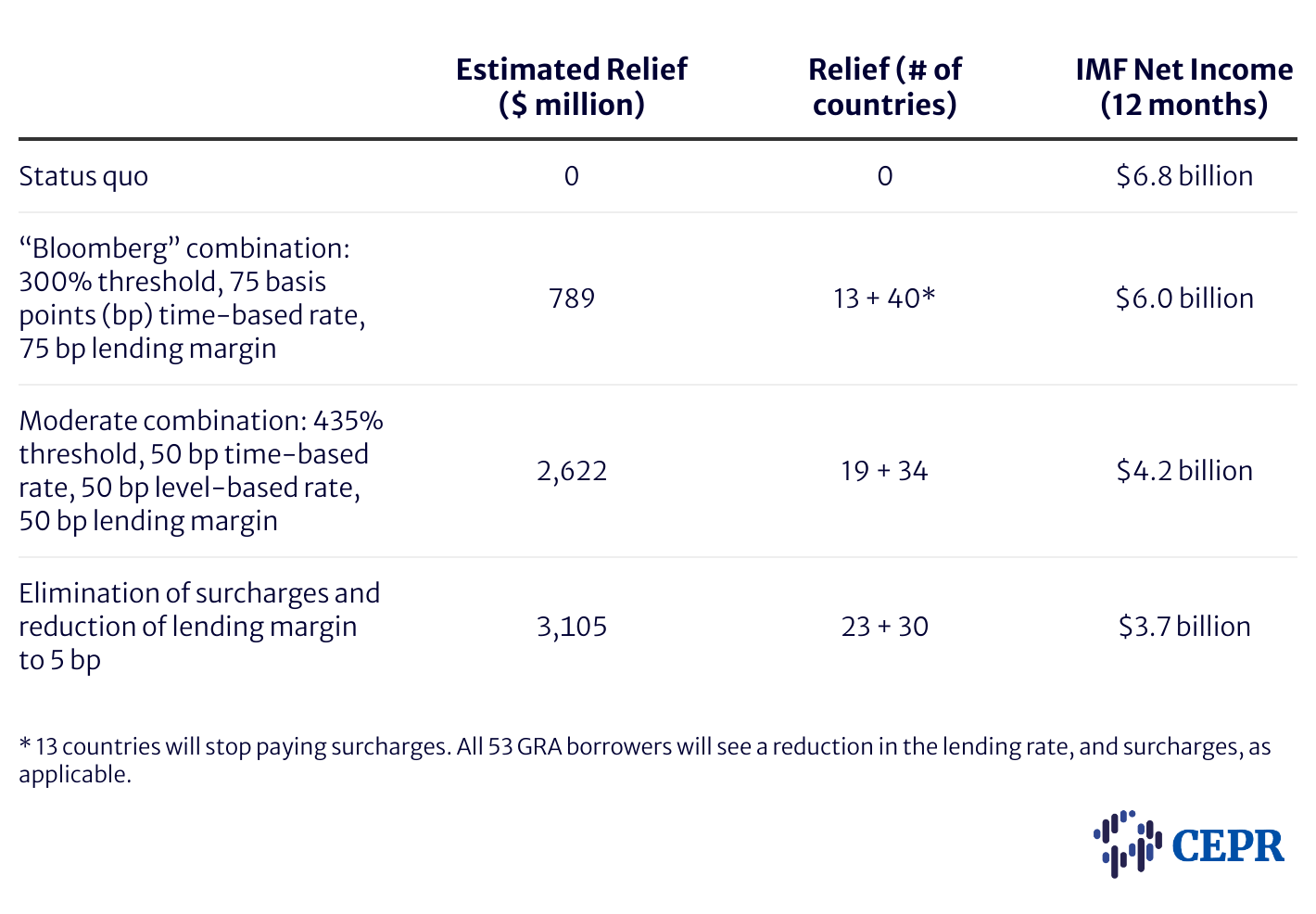

The post examines possible reforms to the surcharge policy based on 1) raising the threshold of outstanding debt to the IMF at which surcharges are imposed, 2) reducing the surcharge level-based and time-based rates, and 3) reducing the basic lending rate. It proposes an ideal combination of completely eliminating surcharges and — given the drastic increase in the Special Drawing Right (SDR) interest rate — a reduction in the lending margin to 5 basis points. “This would yield $3.1 billion in much-needed relief to 53 emerging and developing countries,” Arauz and Vasic-Lalovic write, while “The IMF’s bottom line would go back to historic levels, from $6.8 billion to a perfectly viable $3.7 billion.”

Failing removal of the surcharge policy, at a minimum, the authors write, the Fund should enact a combination of measures including (1) an increase in the surcharge threshold to 435 percent of quota (the Fund’s threshold for exceptional access to additional credit), (2.1) a reduction of the time-based rate to 50 basis points, (2.2) a reduction of the level-based rate to 50 basis points, and (3) a reduction of the lending margin of the basic rate to 50 basis points.

This combination would yield $2.6 billion in much-needed relief to 53 emerging and developing countries and would still keep the IMF’s net income at record-levels.

Table 2. Three Scenarios of Combined Measures for Surcharge Reform at the IMF Board

“The IMF should act now and help alleviate the growing global debt crisis which has been worsened by a number of factors, including higher US interest rates and the impacts of climate-related disasters,” Ivana Vasic-Lalovic said. “There are precedents for significant adjustments to — even removal of — the surcharge policy, and in the midst of serious global crises and a dismal post-pandemic economic outlook, the IMF should act again.”

###