• HousingRentUnited StatesEE. UU.

Read More Leer más Join the discussion Participa en la discusión

This is Dean’s colleague Dawn, CEPR’s Development Director, taking over his blog as I have done for the past 15 years to thank you for supporting Dean’s work! Please bear with me, those of you who have read my hijacked posts over the years, because I’m going to make the same spiel as always.

OK, for those of you who don’t know, Dean makes a point of providing all of his work for F-R-E-E. His books are free to download! His Patreon account is set at the minimum pledge of $1.00 per month, and if it were up to Dean it would be $0. (Please consider signing up to be a patron of BTP!)

While I find Dean’s morals and ethics to be beyond reproach, as a fundraiser he makes my job extremely difficult. Unlike other think tanks, CEPR doesn’t offer special access to our researchers for a fee. We don’t take any corporate funding (not that billion-dollar corporations are knocking down our door. Right, Elon?). We truly rely on the generosity of individual donors to help fund our work.

On behalf of Dean and everyone at CEPR, many thanks for supporting us this past year. If you haven’t already, please consider donating to CEPR this holiday season.

OK, back to your regularly scheduled program. And remember, as Dean always says: Don’t believe everything you read in the papers (or online).

This is Dean’s colleague Dawn, CEPR’s Development Director, taking over his blog as I have done for the past 15 years to thank you for supporting Dean’s work! Please bear with me, those of you who have read my hijacked posts over the years, because I’m going to make the same spiel as always.

OK, for those of you who don’t know, Dean makes a point of providing all of his work for F-R-E-E. His books are free to download! His Patreon account is set at the minimum pledge of $1.00 per month, and if it were up to Dean it would be $0. (Please consider signing up to be a patron of BTP!)

While I find Dean’s morals and ethics to be beyond reproach, as a fundraiser he makes my job extremely difficult. Unlike other think tanks, CEPR doesn’t offer special access to our researchers for a fee. We don’t take any corporate funding (not that billion-dollar corporations are knocking down our door. Right, Elon?). We truly rely on the generosity of individual donors to help fund our work.

On behalf of Dean and everyone at CEPR, many thanks for supporting us this past year. If you haven’t already, please consider donating to CEPR this holiday season.

OK, back to your regularly scheduled program. And remember, as Dean always says: Don’t believe everything you read in the papers (or online).

Read More Leer más Join the discussion Participa en la discusión

• Health and Social ProgramsLos Programas Sociales y de Salud

Since coming to Washington more than three decades ago, I have spent much of my time working on retirement income. The biggest part of that story was defending Social Security, which leaders in both parties were anxious to cut. This defense was largely successful, as the efforts to privatize it in the 1990s and under President Bush were beaten back, and the efforts at cuts often focused on the annual cost of living adjustment, were similarly derailed.

Defending Social Security was crucial, both because tens of millions of people depend on it for most or all of their income, but also because it was a model social program. The administrative costs are minimal, with the total program’s costs coming to less than 0.6 percent of annual benefits, with the costs of the retirement program alone coming to less than 0.4 percent of benefits. By comparison, the fees from private 401(k)s run in the neighborhood of 15 to 20 percent of annual retirement benefits.

There is also very little fraud in the program. The Washington Post, which has long been one of the leading advocates for cutting Social Security in both its opinion and news sections, once devoted a major investigative piece to exposing the fact that 0.006 percent of benefit payments went to dead people, more than half of which were later recovered. It lately decried Social Security as a “mess” in the headline to a full-page article.

I always felt that it was essential to defend Social Security because it could serve as a model for other programs, like universal Medicare or child care. But, as necessary as Social Security is, I also recognized the need to have some additional retirement income for much of the population.

Supplements to Social Security

The traditional story about retirement income was that it was a three-legged stool. Workers were supposed to have Social Security as their core retirement income. In addition, they should have a workplace pension, and also personal savings. That story could reasonably accurately describe the situation of millions of middle-class workers in the years after World War II to the 1990s, but in recent decades the other two legs of this stool have been largely removed.

Traditionally defined benefit pensions (DB) have been eliminated mainly in the private sector. While current retirees can still often count on income from DB pensions, this will be less true going forward. And, most middle-income and moderate-income households have little by way of traditional savings to help support them in retirement. Also, the story of a middle-class household reaching retirement with a paid off mortgage is far less common today than four decades ago.

All of this pointed to the need for some supplement to Social Security. For the lowest income workers, it is not plausible that they will be able to accumulate substantial savings for retirement. People struggling to pay the rent are not going to have tens of thousands stashed away in retirement accounts. The best solution here is an increase in benefits for low-paid workers.

There have been many proposals for increased benefits for lower income workers over the years, some of which had some bipartisan support. For example, giving surviving spouses 75 percent of the joint benefit (compared to the current 66.7 percent, which is often the case now), would be a substantial benefit boost to many of the elderly, generally women. This change can be structured in a way where the cost would be minimal, while providing more than a 12 percent increase in the income of many people who can really use it. There have been many Republicans who have indicated support for this sort of benefit change, although sometimes paring it with cuts that make it unacceptable.

Anyhow, while increased benefits for lower paid workers can drastically improve their well-being in retirement, substantial increases in benefits for middle income workers would be costly. A Social Security program that, by itself, allowed middle-income workers to sustain their living standards in retirement would have to be close to twice the size of the current program. That does not look very feasible.

For this reason, many of us have sought to create a simple low-cost voluntary retirement program that would supplement Social Security. The idea was to make it easy and cheap for workers to save for retirement.

The strategy takes advantage of one of the clearest findings from behavioral economics. When it comes to voluntary retirement plans, workers will overwhelmingly go with a default option. If they are automatically enrolled in a plan, with the option to disenroll, many more workers will stay with the retirement plan than if they have to make the decision to actively enroll in the plan. This is true even when there is money on the table in the form of a matching contribution from an employer.

For this reason, the idea was to make enrollment the default option. If workers decided that it was more important that they have the money to meet current expenses, they just have to opt out of their retirement plan.

That is the simple part. The cheap part was to have a low-cost plan available to all workers. Many 401(k)s and IRA(s) rip-off their participants. Average fees for 401(k)s are in the range of 1.0 percent a year for the company managing the account, with fees for the funds in the account sometimes adding another 1.0 percentage point.

If that seems trivial, consider that a middle-income person can easily accumulate $70,000 in a retirement account towards the end of their working life-time. Imagine paying $1,400 a year, to someone you don’t know, for essentially doing nothing. Taken over a working lifetime, a middle-income worker can easily be throwing $20,000 in the toilet (i.e. providing income to the financial sector) in excess account fees. This is money that will come directly out of their retirement savings.

For this reason, we felt that it was essential that the retirement accounts be coupled with a low-cost investment option. The dream for many of us pushing on this issue is that workers would be able to buy into the Federal Employees’ Thrift Saving Plan, which has fees in the neighborhood of 0.1 percent on its accounts, including the fees charged for individual funds.

The State-by-State Strategy

With action at the federal level largely blocked, the focus was on getting states with relatively progressive governors and legislatures to take the lead in both requiring employers to offer workers retirement accounts and to give them a low-cost option. The simple route for the latter was to open up the retirement system for the state’s public sector workers to workers for private employers.

This did not mean co-mingling funds; public sector employees’ pensions would not be affected. The plan was simply to take advantage of the expertise available in the public pension funds to allow workers in the private sector the same investment options. The administrative costs of the state plans are in general far lower than for private sector 401(k)s, so this meant substantial savings for workers.

Several states went this route, notably, Illinois led the way in 2018 with its Secure Choice program, with New York and California also implementing comparable programs. As it is, a large share of the nation’s workers now lives in a state where most employers are required to enroll workers in retirement plans managed by the government’s public employee pension system unless they offer their own plan.

Secure 2.0 Makes Default Accounts National

In order to ensure that all workers have a decent living standard in retirement it is necessary to have a national program. The Secure 2.0 Act provisions in the omnibus spending go a very long way in this direction. They will require employers with more than ten workers to put at least 3.0 percent of their pay in a retirement fund each year for their workers. The amount will rise by a percentage point each year, until it hits 10 percent.

This is an optional contribution on the part of the employee, they can choose to have this money in their paycheck, if they would prefer to have the money now. In effect, this is just changing the default option. They will be saving, unless they choose not to, rather than the current situation where they have to make a conscious choice to save for retirement.

Another provision in the bill makes the savers’ credit fully refundable. This is a federal tax credit that matched contributions to retirement accounts by low- and moderate-income workers. The problem was that it was not refundable so most of the people with an income low enough to qualify couldn’t benefit since they didn’t owe any income tax. The Secure 2.0 Act provisions fix this so these workers can get the credit even if they don’t owe any income tax.

The Secure 2.0 Act provisions are a big victory, but they don’t address the cost half of the picture. It would be great if, as part of this bill, every worker had the option to have their money invested through the Federal Thrift Savings Plan. Unfortunately, this is not the case. Workers will have to use private insurance companies and brokerages. This means much of their money will be diverted to the Wall Street types.

That is likely a big factor in how the Secure 2.0 provisions got added to the Omnibus bill. While it is great that workers will have more savings for retirement, this bill can mean big money for the financial industry. If the bill increases retirement assets by $1 trillion after ten years (defined contribution plans already have over $6 trillion in assets), it will mean over $10 billion a year in fees for the industry, if the average cost of an account is 1.0 percent of assets. If it is 1.5 percent, adding in the fees for individual funds, that would come to $15 billion a year in fees.

On the other hand, if everyone had the option to invest in the Federal Thrift Savings Plan, we would likely see much of the $6 trillion in assets currently managed by the industry begin to migrate to the federal plan. After all, not that many people are so enamored of insurance companies that they would be willing to throw away thousands of dollars to keep them happy. In that story, they would have more than $60 billion in annual fees at risk, real money even in Washington.

If neo-liberals actually care about efficiency, as they profess, they would be all over this one. After all, the money saved by having a more efficient retirement system would swamp the money involved in tariffs on steel and other things that get them excited. But no one expects neo-liberals to be consistent.

Allowing people to opt into the Federal Thrift Savings Plan should be an ongoing demand for progressives going forward. The industry will be prepared to kill to prevent this from happening, but they lack a serious argument. After all, we can steal a line from their Social Security privatization efforts, “what’s wrong with giving people a choice?”

The State-by-State Strategy

The passage of the Secure Act 2.0 provisions is also a vindication of the state-by-state strategy that progressives have been pursuing for the last quarter century when action at the national level seems blocked. This has been done with increases to the minimum wage, paid sick days and family leave, support for child care, and a number of other areas.

This strategy is effective in both directly providing benefits to large numbers of people, especially in large states like California and New York, and also making policies seem feasible to much of the country. Many of us have been in the habit of pointing to policies successfully implemented in places like Germany, France, or Denmark, but to much of the country we might just as well be talking about Mars. When we can point to a state that has a $15 minimum wage or paid family leave, it sounds like a plausible option for the country.

In the case of the Secure Act 2.0 provisions, many states had already implemented similar bills without the catastrophic effects that businesses often claim will result from progressive legislation. This could give members of Congress confidence that businesses can easily deal with the requirements in the bill.

It also may be good for many companies since offering a retirement plan may help them retain good workers. It’s true that businesses already have this option, but as behavioral economics teaches us, people may often not do what is best for them.

Anyhow, this is one more vindication of the strategy to pursue policies at the state, or even local level, when the prospects for federal action seem bleak. (Yes, I do talk about this in Rigged [it’s free].) It is nice to see a victory here – a good holiday present for tens of millions of workers who stand to benefit.

Since coming to Washington more than three decades ago, I have spent much of my time working on retirement income. The biggest part of that story was defending Social Security, which leaders in both parties were anxious to cut. This defense was largely successful, as the efforts to privatize it in the 1990s and under President Bush were beaten back, and the efforts at cuts often focused on the annual cost of living adjustment, were similarly derailed.

Defending Social Security was crucial, both because tens of millions of people depend on it for most or all of their income, but also because it was a model social program. The administrative costs are minimal, with the total program’s costs coming to less than 0.6 percent of annual benefits, with the costs of the retirement program alone coming to less than 0.4 percent of benefits. By comparison, the fees from private 401(k)s run in the neighborhood of 15 to 20 percent of annual retirement benefits.

There is also very little fraud in the program. The Washington Post, which has long been one of the leading advocates for cutting Social Security in both its opinion and news sections, once devoted a major investigative piece to exposing the fact that 0.006 percent of benefit payments went to dead people, more than half of which were later recovered. It lately decried Social Security as a “mess” in the headline to a full-page article.

I always felt that it was essential to defend Social Security because it could serve as a model for other programs, like universal Medicare or child care. But, as necessary as Social Security is, I also recognized the need to have some additional retirement income for much of the population.

Supplements to Social Security

The traditional story about retirement income was that it was a three-legged stool. Workers were supposed to have Social Security as their core retirement income. In addition, they should have a workplace pension, and also personal savings. That story could reasonably accurately describe the situation of millions of middle-class workers in the years after World War II to the 1990s, but in recent decades the other two legs of this stool have been largely removed.

Traditionally defined benefit pensions (DB) have been eliminated mainly in the private sector. While current retirees can still often count on income from DB pensions, this will be less true going forward. And, most middle-income and moderate-income households have little by way of traditional savings to help support them in retirement. Also, the story of a middle-class household reaching retirement with a paid off mortgage is far less common today than four decades ago.

All of this pointed to the need for some supplement to Social Security. For the lowest income workers, it is not plausible that they will be able to accumulate substantial savings for retirement. People struggling to pay the rent are not going to have tens of thousands stashed away in retirement accounts. The best solution here is an increase in benefits for low-paid workers.

There have been many proposals for increased benefits for lower income workers over the years, some of which had some bipartisan support. For example, giving surviving spouses 75 percent of the joint benefit (compared to the current 66.7 percent, which is often the case now), would be a substantial benefit boost to many of the elderly, generally women. This change can be structured in a way where the cost would be minimal, while providing more than a 12 percent increase in the income of many people who can really use it. There have been many Republicans who have indicated support for this sort of benefit change, although sometimes paring it with cuts that make it unacceptable.

Anyhow, while increased benefits for lower paid workers can drastically improve their well-being in retirement, substantial increases in benefits for middle income workers would be costly. A Social Security program that, by itself, allowed middle-income workers to sustain their living standards in retirement would have to be close to twice the size of the current program. That does not look very feasible.

For this reason, many of us have sought to create a simple low-cost voluntary retirement program that would supplement Social Security. The idea was to make it easy and cheap for workers to save for retirement.

The strategy takes advantage of one of the clearest findings from behavioral economics. When it comes to voluntary retirement plans, workers will overwhelmingly go with a default option. If they are automatically enrolled in a plan, with the option to disenroll, many more workers will stay with the retirement plan than if they have to make the decision to actively enroll in the plan. This is true even when there is money on the table in the form of a matching contribution from an employer.

For this reason, the idea was to make enrollment the default option. If workers decided that it was more important that they have the money to meet current expenses, they just have to opt out of their retirement plan.

That is the simple part. The cheap part was to have a low-cost plan available to all workers. Many 401(k)s and IRA(s) rip-off their participants. Average fees for 401(k)s are in the range of 1.0 percent a year for the company managing the account, with fees for the funds in the account sometimes adding another 1.0 percentage point.

If that seems trivial, consider that a middle-income person can easily accumulate $70,000 in a retirement account towards the end of their working life-time. Imagine paying $1,400 a year, to someone you don’t know, for essentially doing nothing. Taken over a working lifetime, a middle-income worker can easily be throwing $20,000 in the toilet (i.e. providing income to the financial sector) in excess account fees. This is money that will come directly out of their retirement savings.

For this reason, we felt that it was essential that the retirement accounts be coupled with a low-cost investment option. The dream for many of us pushing on this issue is that workers would be able to buy into the Federal Employees’ Thrift Saving Plan, which has fees in the neighborhood of 0.1 percent on its accounts, including the fees charged for individual funds.

The State-by-State Strategy

With action at the federal level largely blocked, the focus was on getting states with relatively progressive governors and legislatures to take the lead in both requiring employers to offer workers retirement accounts and to give them a low-cost option. The simple route for the latter was to open up the retirement system for the state’s public sector workers to workers for private employers.

This did not mean co-mingling funds; public sector employees’ pensions would not be affected. The plan was simply to take advantage of the expertise available in the public pension funds to allow workers in the private sector the same investment options. The administrative costs of the state plans are in general far lower than for private sector 401(k)s, so this meant substantial savings for workers.

Several states went this route, notably, Illinois led the way in 2018 with its Secure Choice program, with New York and California also implementing comparable programs. As it is, a large share of the nation’s workers now lives in a state where most employers are required to enroll workers in retirement plans managed by the government’s public employee pension system unless they offer their own plan.

Secure 2.0 Makes Default Accounts National

In order to ensure that all workers have a decent living standard in retirement it is necessary to have a national program. The Secure 2.0 Act provisions in the omnibus spending go a very long way in this direction. They will require employers with more than ten workers to put at least 3.0 percent of their pay in a retirement fund each year for their workers. The amount will rise by a percentage point each year, until it hits 10 percent.

This is an optional contribution on the part of the employee, they can choose to have this money in their paycheck, if they would prefer to have the money now. In effect, this is just changing the default option. They will be saving, unless they choose not to, rather than the current situation where they have to make a conscious choice to save for retirement.

Another provision in the bill makes the savers’ credit fully refundable. This is a federal tax credit that matched contributions to retirement accounts by low- and moderate-income workers. The problem was that it was not refundable so most of the people with an income low enough to qualify couldn’t benefit since they didn’t owe any income tax. The Secure 2.0 Act provisions fix this so these workers can get the credit even if they don’t owe any income tax.

The Secure 2.0 Act provisions are a big victory, but they don’t address the cost half of the picture. It would be great if, as part of this bill, every worker had the option to have their money invested through the Federal Thrift Savings Plan. Unfortunately, this is not the case. Workers will have to use private insurance companies and brokerages. This means much of their money will be diverted to the Wall Street types.

That is likely a big factor in how the Secure 2.0 provisions got added to the Omnibus bill. While it is great that workers will have more savings for retirement, this bill can mean big money for the financial industry. If the bill increases retirement assets by $1 trillion after ten years (defined contribution plans already have over $6 trillion in assets), it will mean over $10 billion a year in fees for the industry, if the average cost of an account is 1.0 percent of assets. If it is 1.5 percent, adding in the fees for individual funds, that would come to $15 billion a year in fees.

On the other hand, if everyone had the option to invest in the Federal Thrift Savings Plan, we would likely see much of the $6 trillion in assets currently managed by the industry begin to migrate to the federal plan. After all, not that many people are so enamored of insurance companies that they would be willing to throw away thousands of dollars to keep them happy. In that story, they would have more than $60 billion in annual fees at risk, real money even in Washington.

If neo-liberals actually care about efficiency, as they profess, they would be all over this one. After all, the money saved by having a more efficient retirement system would swamp the money involved in tariffs on steel and other things that get them excited. But no one expects neo-liberals to be consistent.

Allowing people to opt into the Federal Thrift Savings Plan should be an ongoing demand for progressives going forward. The industry will be prepared to kill to prevent this from happening, but they lack a serious argument. After all, we can steal a line from their Social Security privatization efforts, “what’s wrong with giving people a choice?”

The State-by-State Strategy

The passage of the Secure Act 2.0 provisions is also a vindication of the state-by-state strategy that progressives have been pursuing for the last quarter century when action at the national level seems blocked. This has been done with increases to the minimum wage, paid sick days and family leave, support for child care, and a number of other areas.

This strategy is effective in both directly providing benefits to large numbers of people, especially in large states like California and New York, and also making policies seem feasible to much of the country. Many of us have been in the habit of pointing to policies successfully implemented in places like Germany, France, or Denmark, but to much of the country we might just as well be talking about Mars. When we can point to a state that has a $15 minimum wage or paid family leave, it sounds like a plausible option for the country.

In the case of the Secure Act 2.0 provisions, many states had already implemented similar bills without the catastrophic effects that businesses often claim will result from progressive legislation. This could give members of Congress confidence that businesses can easily deal with the requirements in the bill.

It also may be good for many companies since offering a retirement plan may help them retain good workers. It’s true that businesses already have this option, but as behavioral economics teaches us, people may often not do what is best for them.

Anyhow, this is one more vindication of the strategy to pursue policies at the state, or even local level, when the prospects for federal action seem bleak. (Yes, I do talk about this in Rigged [it’s free].) It is nice to see a victory here – a good holiday present for tens of millions of workers who stand to benefit.

Read More Leer más Join the discussion Participa en la discusión

One not so good item in the package of retirement fund provisions in the omnibus funding bill raises the age for mandatory distributions from retirement accounts from 72 to 75. This is phased in over a decade, but it does go up immediately to 73 in 2023. It had already been raised from 70.5 years to 72 years in 2019.

The mandatory distribution requirement is based on life expectancy at your current age. This means, for example, if your life expectancy at 72 is ten years, then you have to withdraw (and pay taxes) on roughly 10 percent of the money in your IRA or 401(k). The actual calculations are somewhat more complicated, but this is the basic story.

Anyhow, the ostensible justification for raising the age for mandatory withdrawals was that people are worried about outliving their retirement funds. It is important to realize that this is not really the issue with mandatory withdrawals.

The mandate doesn’t require that people spend the money from their accounts, it just requires they pay taxes on them. This means, for example, if someone had $70,000 in their retirement account (roughly the median for account holders in their sixties, which is a bit more than half the population), and their required distribution was 10 percent, they would have to pull $7,000 out of their account.

They could put this $7,000 into another investment account, they would just have to pay taxes on this money as though it were normal income. The vast majority of retirees would be paying a tax rate of 10 or 12 percent, which means they would owe $700 to $840 in taxes. The rest of the money could be invested for their later years.

Since they would have to pay taxes on their money when they pulled it out in any case, the only loss is the potential investment income from their tax payments. That is not likely to be a major factor in determining whether they will outlive their retirement savings.

There are of course people in higher tax brackets, especially among those in a position to defer withdrawals from their retirement accounts. For someone in the top 37 percent tax bracket, deferring withdrawals can mean large savings. But it is unlikely that these people are actually worried about outliving their retirement accounts.

For these higher income people, this provision is simply one more way to reduce their tax obligations, as were provisions in the bill that raised caps on contributions. Since very few people were contributing at the current caps, raising the caps is simply a way for high income people to shelter more of their income from taxation.

These giveaways to high income people may have been a price worth paying for the other changes in retirement provisions, such as making the savers credit fully refundable so that low income people can benefit, and also requiring most employers to contribute to their workers’ retirement. However, we should be clear that these provisions are designed so that they will only benefit a small group of people at the top of the income distribution. They are not about making it less likely that middle income people will outlive their retirement savings.

One not so good item in the package of retirement fund provisions in the omnibus funding bill raises the age for mandatory distributions from retirement accounts from 72 to 75. This is phased in over a decade, but it does go up immediately to 73 in 2023. It had already been raised from 70.5 years to 72 years in 2019.

The mandatory distribution requirement is based on life expectancy at your current age. This means, for example, if your life expectancy at 72 is ten years, then you have to withdraw (and pay taxes) on roughly 10 percent of the money in your IRA or 401(k). The actual calculations are somewhat more complicated, but this is the basic story.

Anyhow, the ostensible justification for raising the age for mandatory withdrawals was that people are worried about outliving their retirement funds. It is important to realize that this is not really the issue with mandatory withdrawals.

The mandate doesn’t require that people spend the money from their accounts, it just requires they pay taxes on them. This means, for example, if someone had $70,000 in their retirement account (roughly the median for account holders in their sixties, which is a bit more than half the population), and their required distribution was 10 percent, they would have to pull $7,000 out of their account.

They could put this $7,000 into another investment account, they would just have to pay taxes on this money as though it were normal income. The vast majority of retirees would be paying a tax rate of 10 or 12 percent, which means they would owe $700 to $840 in taxes. The rest of the money could be invested for their later years.

Since they would have to pay taxes on their money when they pulled it out in any case, the only loss is the potential investment income from their tax payments. That is not likely to be a major factor in determining whether they will outlive their retirement savings.

There are of course people in higher tax brackets, especially among those in a position to defer withdrawals from their retirement accounts. For someone in the top 37 percent tax bracket, deferring withdrawals can mean large savings. But it is unlikely that these people are actually worried about outliving their retirement accounts.

For these higher income people, this provision is simply one more way to reduce their tax obligations, as were provisions in the bill that raised caps on contributions. Since very few people were contributing at the current caps, raising the caps is simply a way for high income people to shelter more of their income from taxation.

These giveaways to high income people may have been a price worth paying for the other changes in retirement provisions, such as making the savers credit fully refundable so that low income people can benefit, and also requiring most employers to contribute to their workers’ retirement. However, we should be clear that these provisions are designed so that they will only benefit a small group of people at the top of the income distribution. They are not about making it less likely that middle income people will outlive their retirement savings.

Read More Leer más Join the discussion Participa en la discusión

• Globalization and TradeGlobalización y comercioInequalityLa DesigualdadIntellectual PropertyPropiedad IntelectualUnited StatesEE. UU.

Read More Leer más Join the discussion Participa en la discusión

• Economic Crisis and RecoveryCrisis económica y recuperación

I have been seeing various posts on Twitter from Republican politicians saying how Joe Biden’s inflation is devastating families as we approach the holidays. Of course, it would be amazing if we didn’t have some discomfort given a worldwide pandemic and a major war in Europe, but we can’t expect that Republican politicians would know about such things.

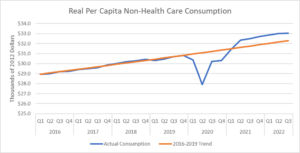

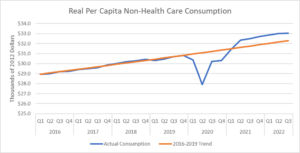

In any case, it is worth seeing the extent to which the data support the Republicans’ tale of hardship. It doesn’t look like the consumption data from the National Income and Product Accounts agree with them. Here’s the picture for real per capita non-health care consumption through the third quarter of 2022.

Source: Bureau of Economic Analysis and author’s calculations.

As can be seen, non-health care consumption, after falling during the worst period of the pandemic, jumped up in 2021, putting it well above its pre-pandemic trend. In the third quarter of this year, real per capita non-health care consumption was 2.3 percent above its pre-pandemic trend. That doesn’t look like a story of hardship.

We do have to ask about distribution, but it doesn’t seem this is simply a story of the Elon Musks of the world living even higher on the hog. As Arin Dube and David Autor have documented, wage growth since the pandemic has been most rapid for those at the bottom end of the wage distribution, and has outpaced inflation for roughly the bottom 40 percent of the distribution.

It is worth commenting on my use of non-health care consumption. Health care is tricky as a category of consumption. What we care about is health, not the number of doctors visits or medical tests we receive.

Spending on health care has slowed sharply since the pandemic. It is not clear why this is the case. If people are substituting telemedicine and home diagnostics for in-person visits and laboratory tests, this could lead to substantial savings. Whether or not it means worse outcomes remains to be seen.

In any case, it is unambiguously the case that people are consuming more non-health care items this holiday season than they would have reason to expect before the pandemic. The Republicans’ grinch routine is just play acting.

I have been seeing various posts on Twitter from Republican politicians saying how Joe Biden’s inflation is devastating families as we approach the holidays. Of course, it would be amazing if we didn’t have some discomfort given a worldwide pandemic and a major war in Europe, but we can’t expect that Republican politicians would know about such things.

In any case, it is worth seeing the extent to which the data support the Republicans’ tale of hardship. It doesn’t look like the consumption data from the National Income and Product Accounts agree with them. Here’s the picture for real per capita non-health care consumption through the third quarter of 2022.

Source: Bureau of Economic Analysis and author’s calculations.

As can be seen, non-health care consumption, after falling during the worst period of the pandemic, jumped up in 2021, putting it well above its pre-pandemic trend. In the third quarter of this year, real per capita non-health care consumption was 2.3 percent above its pre-pandemic trend. That doesn’t look like a story of hardship.

We do have to ask about distribution, but it doesn’t seem this is simply a story of the Elon Musks of the world living even higher on the hog. As Arin Dube and David Autor have documented, wage growth since the pandemic has been most rapid for those at the bottom end of the wage distribution, and has outpaced inflation for roughly the bottom 40 percent of the distribution.

It is worth commenting on my use of non-health care consumption. Health care is tricky as a category of consumption. What we care about is health, not the number of doctors visits or medical tests we receive.

Spending on health care has slowed sharply since the pandemic. It is not clear why this is the case. If people are substituting telemedicine and home diagnostics for in-person visits and laboratory tests, this could lead to substantial savings. Whether or not it means worse outcomes remains to be seen.

In any case, it is unambiguously the case that people are consuming more non-health care items this holiday season than they would have reason to expect before the pandemic. The Republicans’ grinch routine is just play acting.

Read More Leer más Join the discussion Participa en la discusión

I was having an exchange with an old friend on Mastodon (yes, I’m there now @[email protected]), in which I was arguing that the best way to get alternatives to the current patent system was to have examples of successful drugs developed without relying on patent monopolies. Of course, there are great historical examples, like the development of insulin as a treatment for diabetes or the polio vaccine, but it would be good to have one from the current century.

The most obvious example, that really deserves a hell of a lot more attention than it is getting, is the Covid vaccine developed by Peter Hotez and Maria Elena Botazzi at the Center for Vaccine Development at Texas Children’s Hospital. This vaccine was developed using grants in the single digit millions. Unlike the mRNA vaccines developed by Pfizer and Moderna, it uses a long-established technology. It is also completely open-sourced; the technology is fully public and there are no patents or other restrictions preventing its manufacture anywhere in the world.

The vaccine, called Corbevax, is cheap and easy to produce, costing less than $2 per shot. By contrast Pfizer and Moderna charged close to $20 a shot for the initial round of inoculations. They are looking to charge considerably more for subsequent booster rounds. This is in spite of the fact that the U.S. government paid close to $900 million for the development and testing of Moderna’s vaccine, in addition to supporting the development of mRNA technology for decades.

Like the mRNA vaccines, Corbevax is highly effective in preventing serious illness and death. It has been administered to more than 70 million people in India and also is being used in several other developing countries.

Corbevax is an important example of a vaccine being developed without needing government-granted patent monopolies. To be clear, medical researchers need to be compensated for their work. We can’t count of all researchers being as dedicated as doctors Hotez and Botazzi in their commitment to protecting the public’s health.

However, it is absurd to imagine that we cannot get effective research without the allure of great riches promised by the current system. (Moderna’s vaccine created at least five billionaires.) We already have the National Institutes of Health (NIH), which produces great research by paying people decent salaries, but not minting billionaires.

Most of NIH’s funding goes to more basic research rather than actually developing drugs or vaccines, but there is no reason in principle that public money could not be used for downstream research as well as basic research. We might structure a system differently for downstream research. I have argued for long-term contracts, similar to what the Defense Department uses for developing weapon systems, which would be subject to review/renewal periodically (see Rigged, chapter 5 [it’s free].)

While the specific structure is important (we want to make sure a publicly funded system is operating as efficiently as possible), the key issue is establishing the possibility of an alternative to patent monopoly financing of drug development. Towards this end, we need more facts on the ground. We need, one, two, many Corbevaxes.

Sam Bankman-Fried made “effective philanthropy” famous, as giving away money to good causes was the ostensible rationale for the multi-billion dollar crypto scam he was operating. It’s not clear if there are actually any effective philanthropists among the billionaire class. But, if such a creature exists, there could hardly be a better use of their money then demonstrating the feasibility of directly funded open-source drug development. If the next great cancer drug sells for a few hundred dollars, instead of a few hundred thousand, it will be hard to ignore.

At the end of the day, we do of course need governments to pick up the tab, but the potential savings are enormous, perhaps as much as $400 billion a year ($3,000 per family). Getting rid of patent monopolies for drugs would also be a huge factor reducing inequality, as we would not be draining the pockets of ordinary workers to create more Moderna billionaires.

But most importantly, new drugs would be cheap. People in the United States and around the world would be able to afford drugs sold at free market prices, rather than patent monopoly prices. And, that would be great.

I was having an exchange with an old friend on Mastodon (yes, I’m there now @[email protected]), in which I was arguing that the best way to get alternatives to the current patent system was to have examples of successful drugs developed without relying on patent monopolies. Of course, there are great historical examples, like the development of insulin as a treatment for diabetes or the polio vaccine, but it would be good to have one from the current century.

The most obvious example, that really deserves a hell of a lot more attention than it is getting, is the Covid vaccine developed by Peter Hotez and Maria Elena Botazzi at the Center for Vaccine Development at Texas Children’s Hospital. This vaccine was developed using grants in the single digit millions. Unlike the mRNA vaccines developed by Pfizer and Moderna, it uses a long-established technology. It is also completely open-sourced; the technology is fully public and there are no patents or other restrictions preventing its manufacture anywhere in the world.

The vaccine, called Corbevax, is cheap and easy to produce, costing less than $2 per shot. By contrast Pfizer and Moderna charged close to $20 a shot for the initial round of inoculations. They are looking to charge considerably more for subsequent booster rounds. This is in spite of the fact that the U.S. government paid close to $900 million for the development and testing of Moderna’s vaccine, in addition to supporting the development of mRNA technology for decades.

Like the mRNA vaccines, Corbevax is highly effective in preventing serious illness and death. It has been administered to more than 70 million people in India and also is being used in several other developing countries.

Corbevax is an important example of a vaccine being developed without needing government-granted patent monopolies. To be clear, medical researchers need to be compensated for their work. We can’t count of all researchers being as dedicated as doctors Hotez and Botazzi in their commitment to protecting the public’s health.

However, it is absurd to imagine that we cannot get effective research without the allure of great riches promised by the current system. (Moderna’s vaccine created at least five billionaires.) We already have the National Institutes of Health (NIH), which produces great research by paying people decent salaries, but not minting billionaires.

Most of NIH’s funding goes to more basic research rather than actually developing drugs or vaccines, but there is no reason in principle that public money could not be used for downstream research as well as basic research. We might structure a system differently for downstream research. I have argued for long-term contracts, similar to what the Defense Department uses for developing weapon systems, which would be subject to review/renewal periodically (see Rigged, chapter 5 [it’s free].)

While the specific structure is important (we want to make sure a publicly funded system is operating as efficiently as possible), the key issue is establishing the possibility of an alternative to patent monopoly financing of drug development. Towards this end, we need more facts on the ground. We need, one, two, many Corbevaxes.

Sam Bankman-Fried made “effective philanthropy” famous, as giving away money to good causes was the ostensible rationale for the multi-billion dollar crypto scam he was operating. It’s not clear if there are actually any effective philanthropists among the billionaire class. But, if such a creature exists, there could hardly be a better use of their money then demonstrating the feasibility of directly funded open-source drug development. If the next great cancer drug sells for a few hundred dollars, instead of a few hundred thousand, it will be hard to ignore.

At the end of the day, we do of course need governments to pick up the tab, but the potential savings are enormous, perhaps as much as $400 billion a year ($3,000 per family). Getting rid of patent monopolies for drugs would also be a huge factor reducing inequality, as we would not be draining the pockets of ordinary workers to create more Moderna billionaires.

But most importantly, new drugs would be cheap. People in the United States and around the world would be able to afford drugs sold at free market prices, rather than patent monopoly prices. And, that would be great.

Read More Leer más Join the discussion Participa en la discusión

• DebtEconomic Crisis and RecoveryCrisis económica y recuperaciónUnited StatesEE. UU.

Read More Leer más Join the discussion Participa en la discusión

• COVID-19CoronavirusEconomic Crisis and RecoveryCrisis económica y recuperaciónInflationUnited StatesEE. UU.WagesWorkersSector del trabajo

Read More Leer más Join the discussion Participa en la discusión

• HousingInequalityLa DesigualdadUnited StatesEE. UU.

It is getting almost as bad as propaganda from an authoritarian regime. We keep hearing major news outlets tell us that inflation is whacking lower-income families. The Washington Post did it yesterday in an editorial demanding more rate hikes from the Fed to throw people out of work.

Lower-income people, like everyone else, are paying more for food, gas, and rent. The argument is that these items are a larger share of the budget of lower-income people, so they are hit harder by inflation than higher-income households.

The problem with telling this simple story is that wages have been growing most rapidly at the bottom end of the wage distribution, substantially outpacing inflation since the start of the pandemic. Also, in a tight labor market, more people are likely working in many households. They are also more likely to be able to find a job that has lower commuting costs or might allow them to work part-time to deal with child care or family needs.

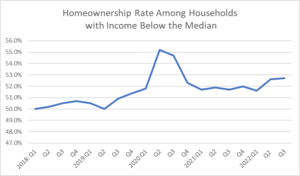

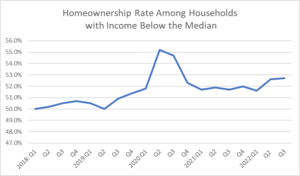

One way to assess how these things balance out is to look at what has happened to homeownership rates. More homeownership is not always better, as some of us warned during the housing bubble years, but people who have the option to buy a home generally choose to do so.

Contrary to the propaganda coming from the media, homeownership rates have actually risen rapidly since the pandemic for households with incomes below the median, as shown below. (The big jump in 2020, which was partially reversed, is likely due to a skewing in responses, as the pandemic sent response rates plummeting.)

Source: Census Bureau (Table 8).

Homeownership rates have also risen for Black and Hispanic households and those headed by someone under age 35. It is more than a bit bizarre that the media have been almost uniformly insisting that these are horrible times for lower-income people despite data that say the opposite.

It is getting almost as bad as propaganda from an authoritarian regime. We keep hearing major news outlets tell us that inflation is whacking lower-income families. The Washington Post did it yesterday in an editorial demanding more rate hikes from the Fed to throw people out of work.

Lower-income people, like everyone else, are paying more for food, gas, and rent. The argument is that these items are a larger share of the budget of lower-income people, so they are hit harder by inflation than higher-income households.

The problem with telling this simple story is that wages have been growing most rapidly at the bottom end of the wage distribution, substantially outpacing inflation since the start of the pandemic. Also, in a tight labor market, more people are likely working in many households. They are also more likely to be able to find a job that has lower commuting costs or might allow them to work part-time to deal with child care or family needs.

One way to assess how these things balance out is to look at what has happened to homeownership rates. More homeownership is not always better, as some of us warned during the housing bubble years, but people who have the option to buy a home generally choose to do so.

Contrary to the propaganda coming from the media, homeownership rates have actually risen rapidly since the pandemic for households with incomes below the median, as shown below. (The big jump in 2020, which was partially reversed, is likely due to a skewing in responses, as the pandemic sent response rates plummeting.)

Source: Census Bureau (Table 8).

Homeownership rates have also risen for Black and Hispanic households and those headed by someone under age 35. It is more than a bit bizarre that the media have been almost uniformly insisting that these are horrible times for lower-income people despite data that say the opposite.

Read More Leer más Join the discussion Participa en la discusión