“Surcharges” are fees levied by the International Monetary Fund (IMF) on loans to countries whose outstanding credit to the IMF exceeds certain time-based and/or level-based thresholds. The fees add two to three percentage points to lending rates, on top of regular interest rates and service fees.

Surcharges have been widely criticized for their procyclical nature, effectively punishing countries that are facing severe liquidity constraints, increasing the risk of debt distress, and diverting scarce resources that could otherwise be used to boost struggling economies, fund health care, or support climate action, among other essential measures. The IMF has provided no evidence that surcharges achieve their stated aim of disincentivizing reliance on the Fund, nor does the IMF currently require the income generated from the policy. (See “IMF Surcharges: Counterproductive and Unfair” for a more complete discussion of the policy and its consequences.)

For many years, these surcharges were applied in an opaque manner; the IMF did not publish information on which countries paid surcharges or how much they paid. It was therefore left to third parties to come up with estimates of surcharge payments. In September 2021, the Center for Economic and Policy Research (CEPR) published a first estimate; later that year the European Network on Debt and Development published their own. CEPR published an updated estimate in April 2023.

The IMF finally began publishing data on surcharge payments via its Financial Data Query Tool in 2023 (the authors’ initial analysis of this data can be found here). The move was a step forward for transparency. But it had a significant limit: while the retrospective data is presumably accurate, the future projections are incomplete. As we wrote at the time:

The IMF’s Query Tool appears to only project surcharge payments on existing loans that were effectively disbursed. It does not include surcharge payments derived from commitments — loans under existing arrangements that have yet to be disbursed (also referred to as “prospective credit”). [While disbursement schedules sometimes change, this prospective credit is typically ultimately disbursed.] This discrepancy means that the IMF’s Query Tool projections of future surcharge payments are significantly lower than what countries will end up paying.

For example, according to the most recent relevant country report, which does project prospective credit, Ukraine is expected to receive more than $10 billion in GRA loans in the next five years. By 2028, the outstanding level of this prospective credit will represent 81 percent of Ukraine’s total outstanding credit. Excluding this prospective credit from projections is likely to greatly underestimate future surcharge payments.

Given this incomplete data, it is still necessary to calculate independent estimates of future surcharge payments in order to have a complete picture of the amount that countries can be expected to pay in surcharges. Using the methodology our colleagues developed in previous publications,1 we present an estimate of IMF surcharges updated as of February 2024. Key findings include:

The IMF levies two types of surcharges. A 200 basis point “level-based” surcharge is levied on any outstanding credit from the IMF’s General Resources Account (GRA) that is in excess of 187.5 percent of a country’s quota at the fund. In addition, a 100 basis point “time-based” surcharge is levied on outstanding GRA credit that has exceeded this threshold for more than 36 or 51 months, depending on the lending facility. Surcharges are only levied on credit from the GRA; lending via the Poverty Reduction and Growth Trust (PRGT) — the main IMF lending facility for borrowers from the International Development Association (IDA) category of countries — and via the Resilience and Sustainability Trust (RST) is not subject to surcharges.

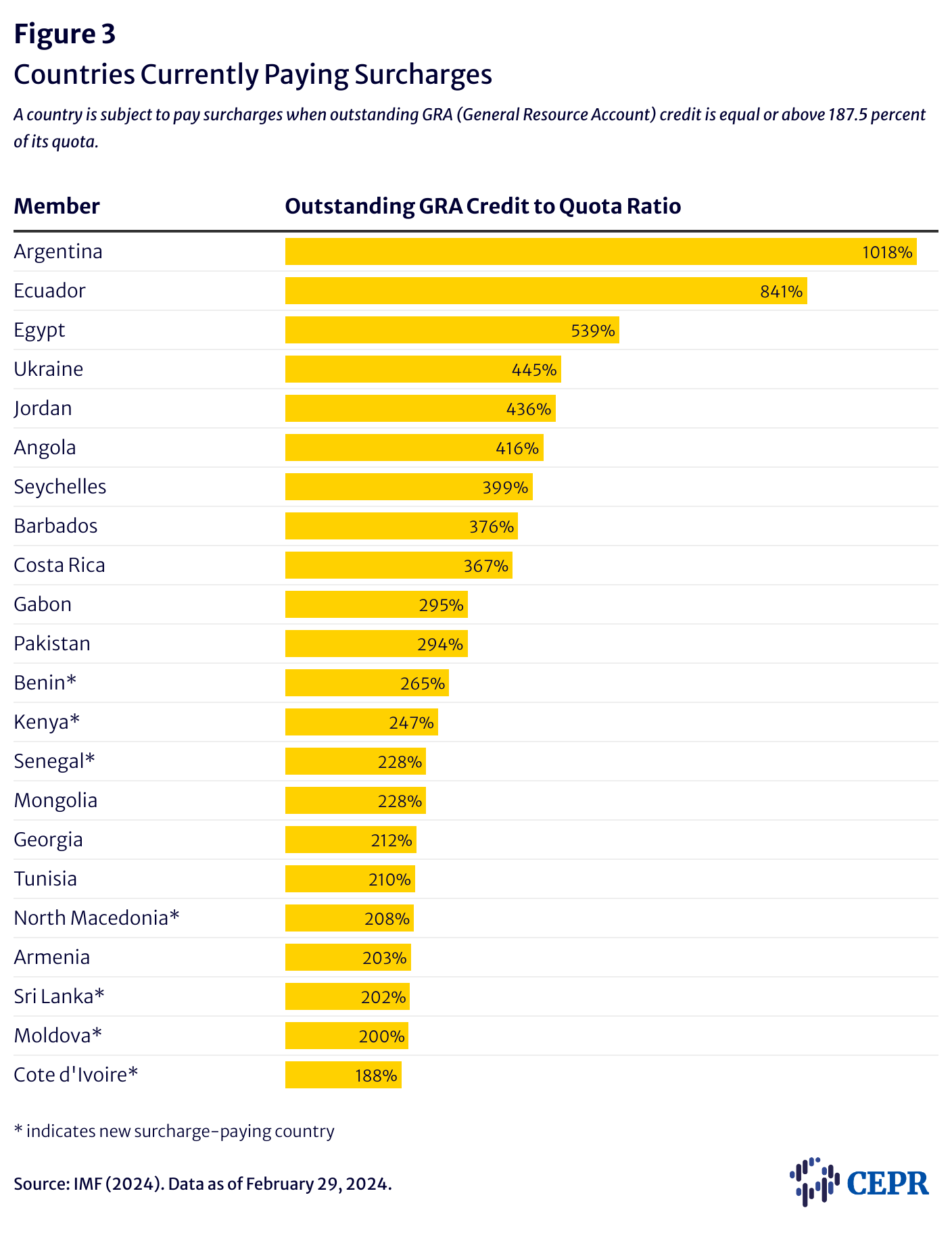

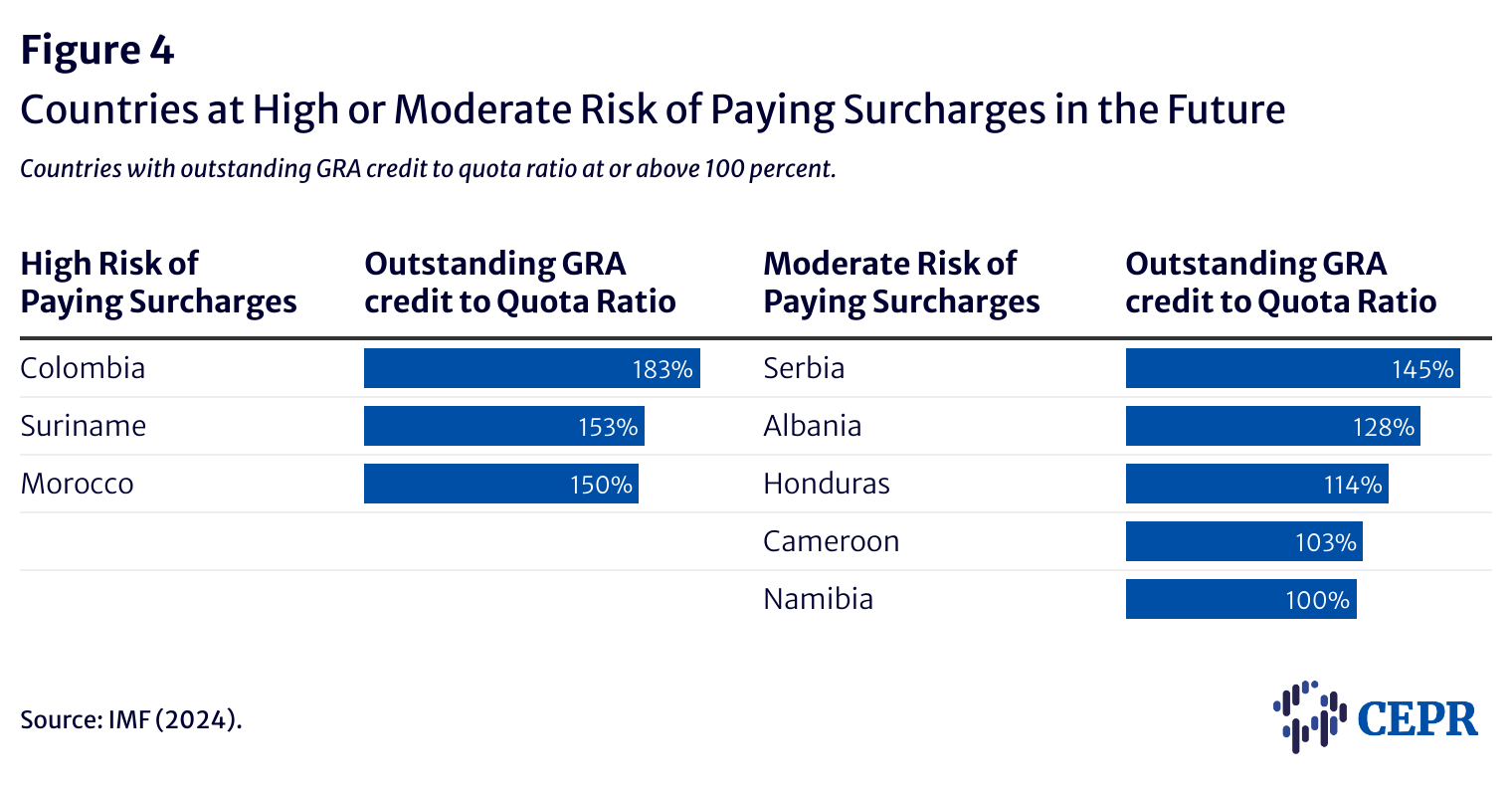

To first determine which countries are paying surcharges, we calculated the outstanding GRA credit to quota ratio for all IMF member countries as of February 29, 2024, using data made available via the IMF’s online data query tool. This calculation yielded 22 countries with a GRA-to-quota ratio in excess of 187.5. Countries with a GRA-to-quota ratio below 187.5 but exceeding 150 or 100 are considered t0 be at “high risk” or “moderate risk,” respectively, of paying surcharges in the future. We then estimate surcharge payments for each of the 22 surcharge-paying countries based on data available in IMF staff reports.

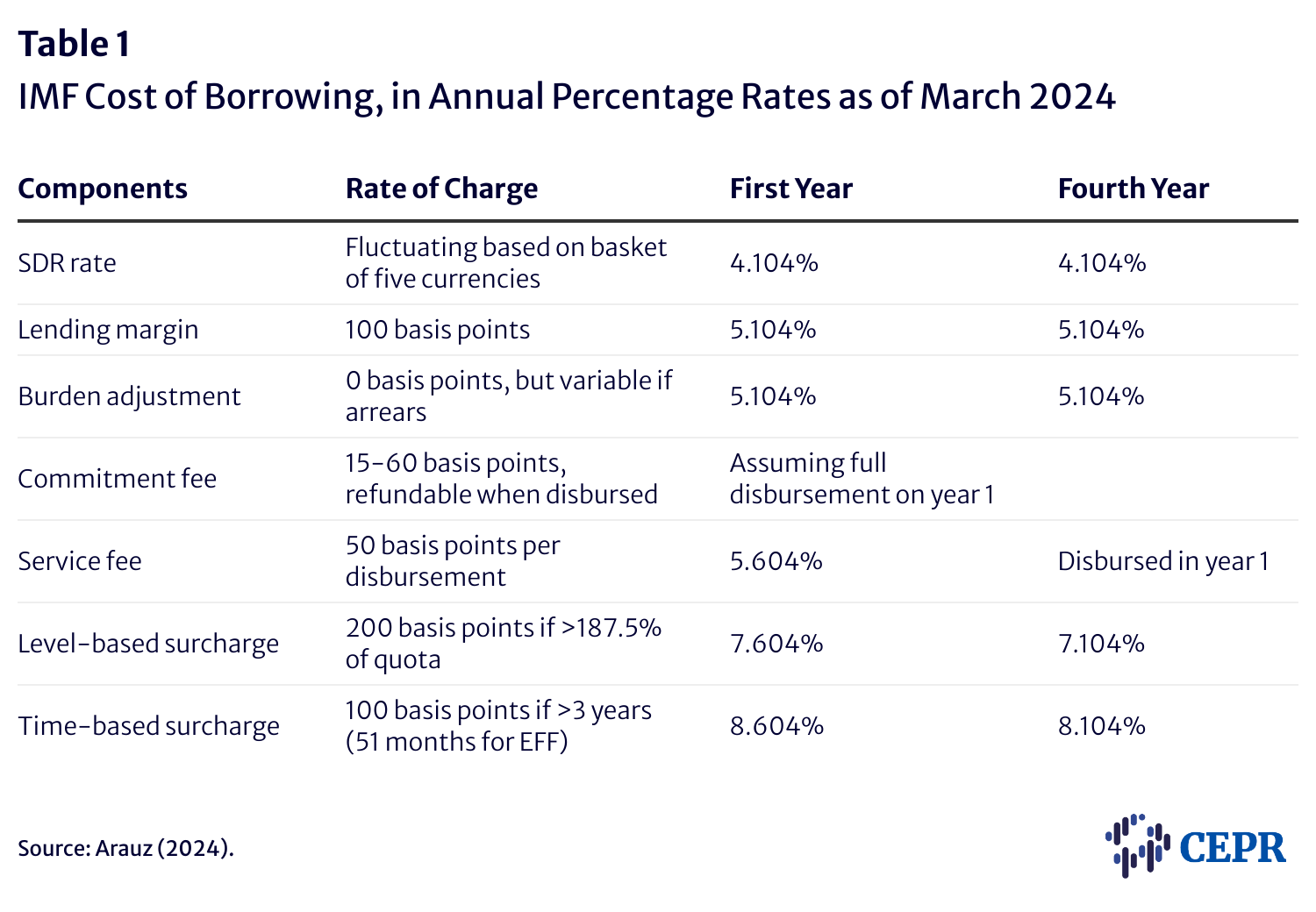

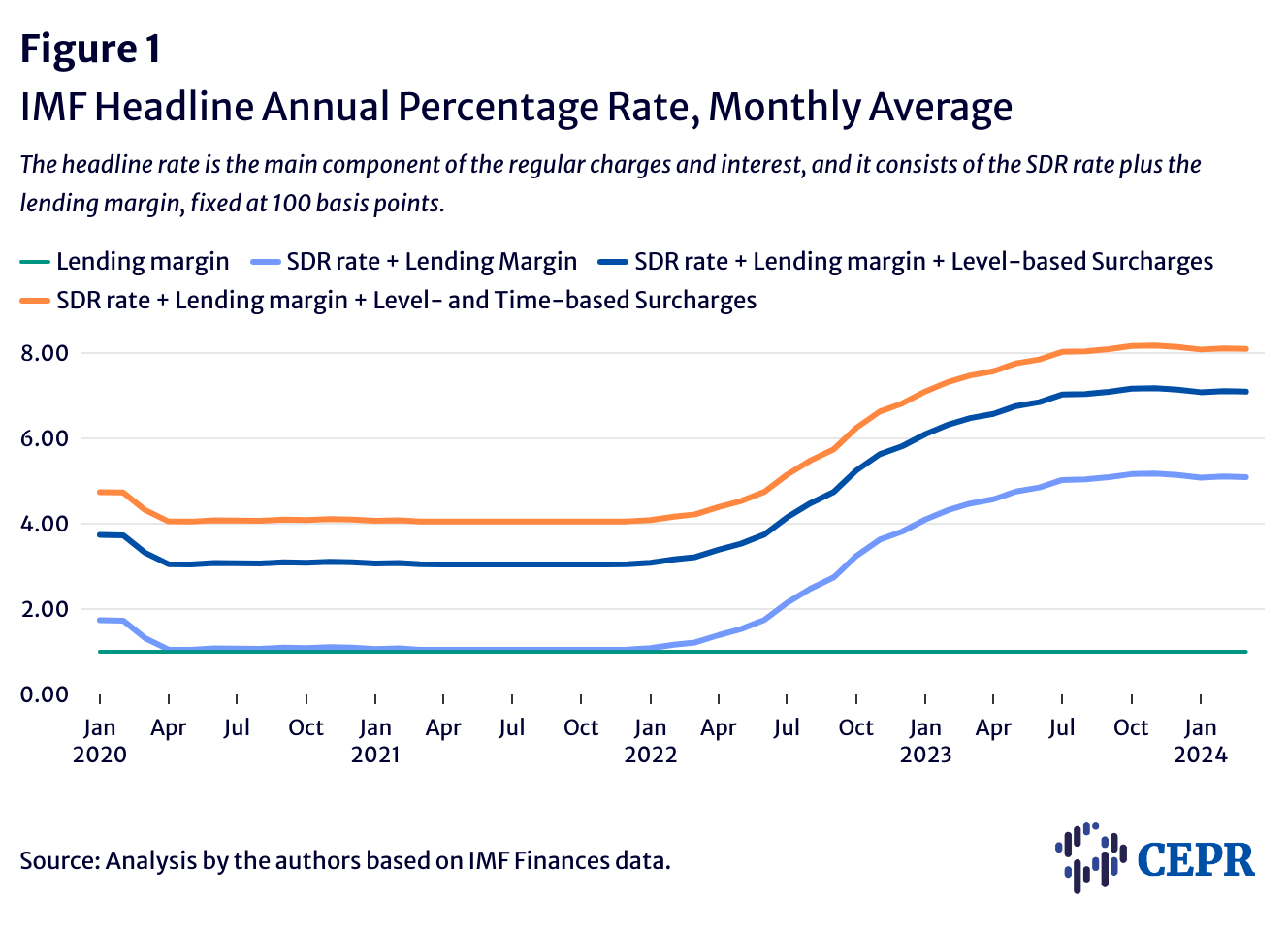

The cost of borrowing from the GRA is made up of a few components (See Table 1). The headline rate, or basic rate of charge, is composed of a fixed 100 basis point lending margin plus a fluctuating Special Drawing Right (SDR) interest rate (See Figure 1)2 The basic rate of charge may in theory be adjusted upward via the Fund’s “burden-sharing mechanism,” but this rate of adjustment has been set at zero since at least January 2020. In addition to this basic rate of charge, the Fund adds a commitment fee (a deposit that is returned if a country maintains its agreement and all loans are disbursed as planned), a service fee (a small charge applied each time new funds are disbursed to the borrower), and surcharges. As a result of a rising SDR rate, some surcharge-paying countries now face an effective lending rate of over 8 percent.

IMF staff reports do not disaggregate the charges paid by borrower countries.3 Typically, IMF staff reports present a borrower country’s annualized schedule of payments to the Fund as “principal” payments and “charges and interest,” which combine all of the above costs. Staff reports also generally provide projected debt stocks and future loan disbursements, both for existing and prospective fund credit. The manner in which these figures are labeled, presented, or broken down, however, is not well standardized across staff reports.

In order to estimate the amount of surcharge payments that countries have to make they must be disaggregated from the total “charges and interest” — and other relevant stocks and flows — published in the most recent IMF staff report for each surcharge-paying country. Because the burden-sharing mechanism is currently set to zero, it is ignored. In line with IMF staff reports, we assume all disbursements for access to Fund credit are effectively made. As “commitment fees” are essentially deposits that are refunded when disbursements are complete, our calculations therefore also ignore commitment fees. This leaves “charges and interest,” comprising four types of charges: costs associated with the basic rate of charge, the service fee, net SDR charges and assessments,4 and surcharges. By calculating and subtracting the former three from the published annual “charges and interest,” we can estimate surcharge payments. In CEPR’s previous estimates, SDR charges and assessments were not subtracted from “charges and interest.” Refer to the Appendix for a more detailed analysis of past estimates.

While the GRA rate of charge fluctuates over time, we use a single rate for projections. When the staff report does not explicitly state this rate, we use the rate of charge on record for the week immediately prior to the report’s publication. We calculate the service fee as 50 basis points of each annual GRA disbursement. When provided, our estimates use existing and prospective credit, assuming that prospective credit will be disbursed.

In cases where a country is borrowing from both the GRA and RST, “charges and interest” typically does not distinguish between the two. In these cases, we must therefore repeat the above process, subtracting the costs associated with the RST rate of charge, as well as RST service fees, from the overall “charges and interest.” RST costs differ according to whether a country is categorized as Group A, B, or C — a determination of the degree of concessionality a country will receive, roughly corresponding to income levels. Its staff report explicitly states a country’s grouping. We use the same process to determine the RST rate of charge as the GRA rate of charge, but instead of the baseline 100 basis point fixed margin, RST lending uses a 25 basis point margin for Group A (with a 2.25 percent maximum rate), 75 basis points for Group B, and 95 for Group C. Similarly, RST service fees differ by group: zero for Group A, 25 basis points for Group B, and 50 basis points for Group C.

The IMF has set the rate of charge for PRGT lending to zero for many years; it has no associated service fees.

While we calculate Benin to be paying surcharges, the staff report did not include enough information for our calculations, so its data is excluded from our statistics. Similarly, not all staff reports included projections through 2033, even in cases where a country is likely to continue paying surcharges up to that year or beyond. Most reports did include projections up to at least 2028; five-year totals and averages are thus likely to be more accurate.

Given the assumptions noted above, incomplete and non-standardized IMF records, and other factors, the figures calculated from this process should be understood as merely a rough estimate of real surcharge payments. However, we assert that they present a more accurate picture than the incomplete data contained in the IMF Financial Data Query Tool, which fails to include surcharges applied to prospective credit. The necessarily imprecise process by which we calculate our estimates would not be necessary if the Fund published all the data related to future surcharge payments.

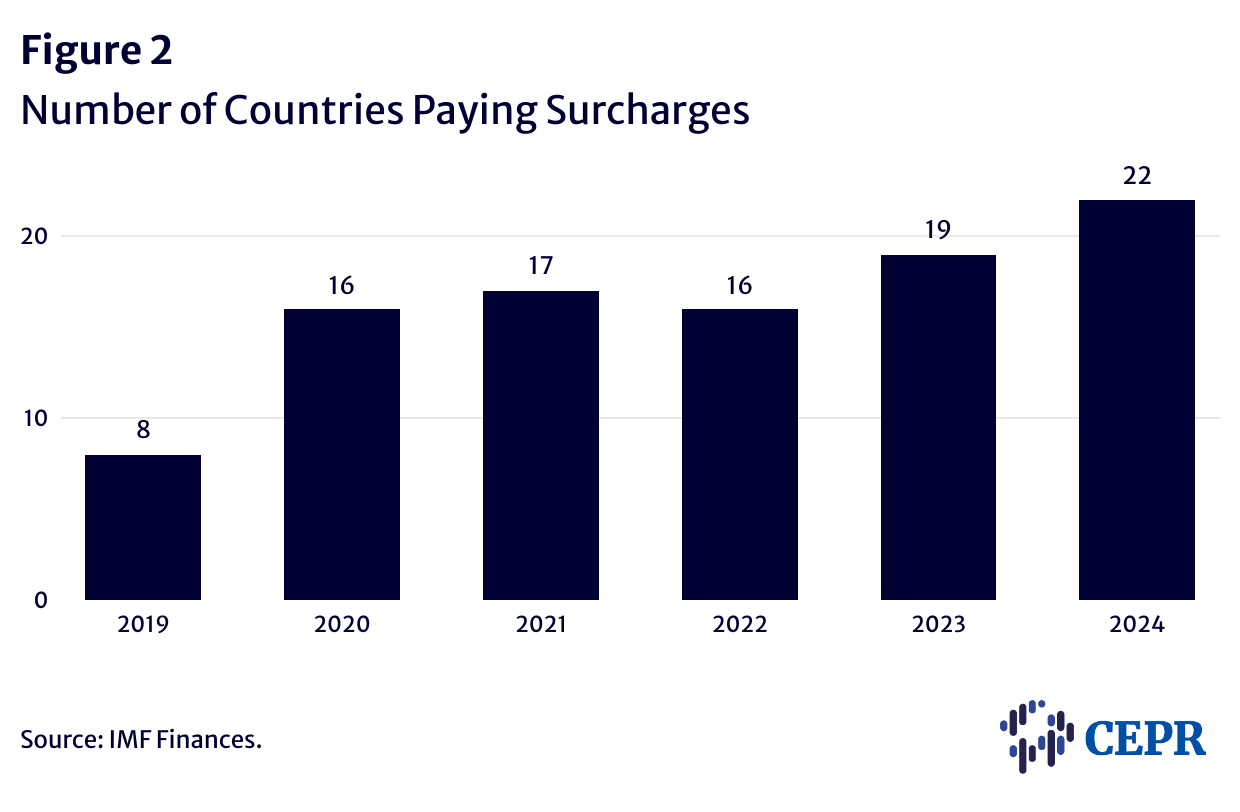

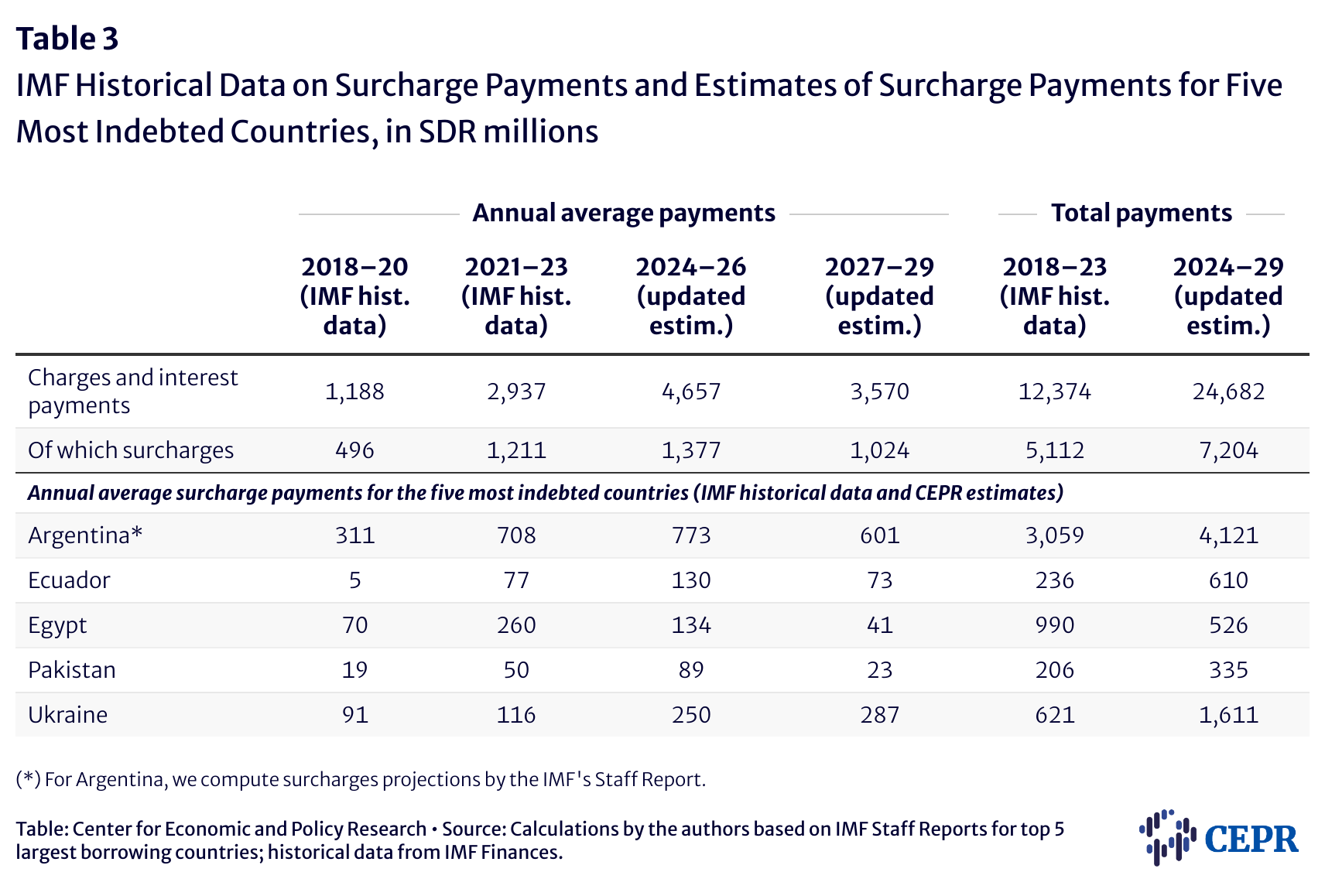

We find that, as of March 2024, 22 countries are paying surcharges — more than at any other moment on record. This is a net increase of six since our 2023 estimate and nearly triple the number of countries (eight) that were paying in 2019, as shown in Figure 2. Since our 2023 estimate, Benin, Côte d’Ivoire, Kenya, Moldova, North Macedonia, Senegal, and Sri Lanka have passed the surcharge threshold. Albania is no longer paying but remains at risk. At the time of our 2023 estimate, only three countries in sub-Saharan Africa were paying surcharges. In our latest estimate, this figure has more than doubled. According to the IMF’s most recent published data, 10 countries pay both level-based and time-based surcharges amounting to 300 basis points, while 12 countries pay only level-based surcharges of 200 basis points.

In addition to the 22 countries currently paying surcharges, we identify three countries that are at high risk of surpassing the surcharge threshold in the near future, and five countries that are at moderate risk of doing so, as shown in Figure 4 below.

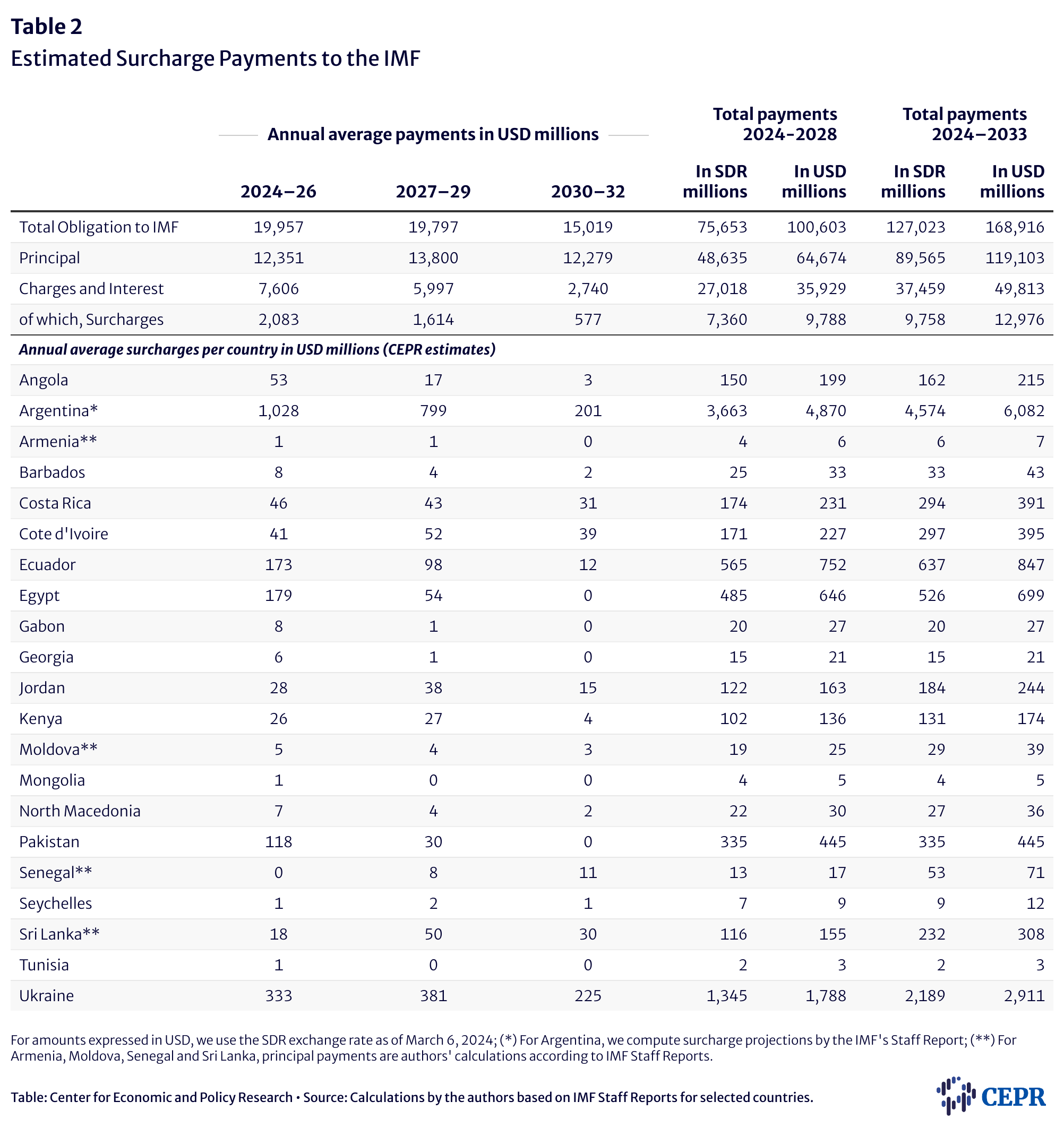

Our results indicate that, over the next five years, the IMF will levy $9.8 billion in surcharges (excluding Benin). Argentina alone is expected to pay roughly half of this total — $4.9 billion — but a number of other countries are heavily impacted. Ukraine, for example, will pay $1.8 billion and Ecuador over $750 billion. Table 2 provides five- and 10-year total estimates for each country for which calculation was possible.

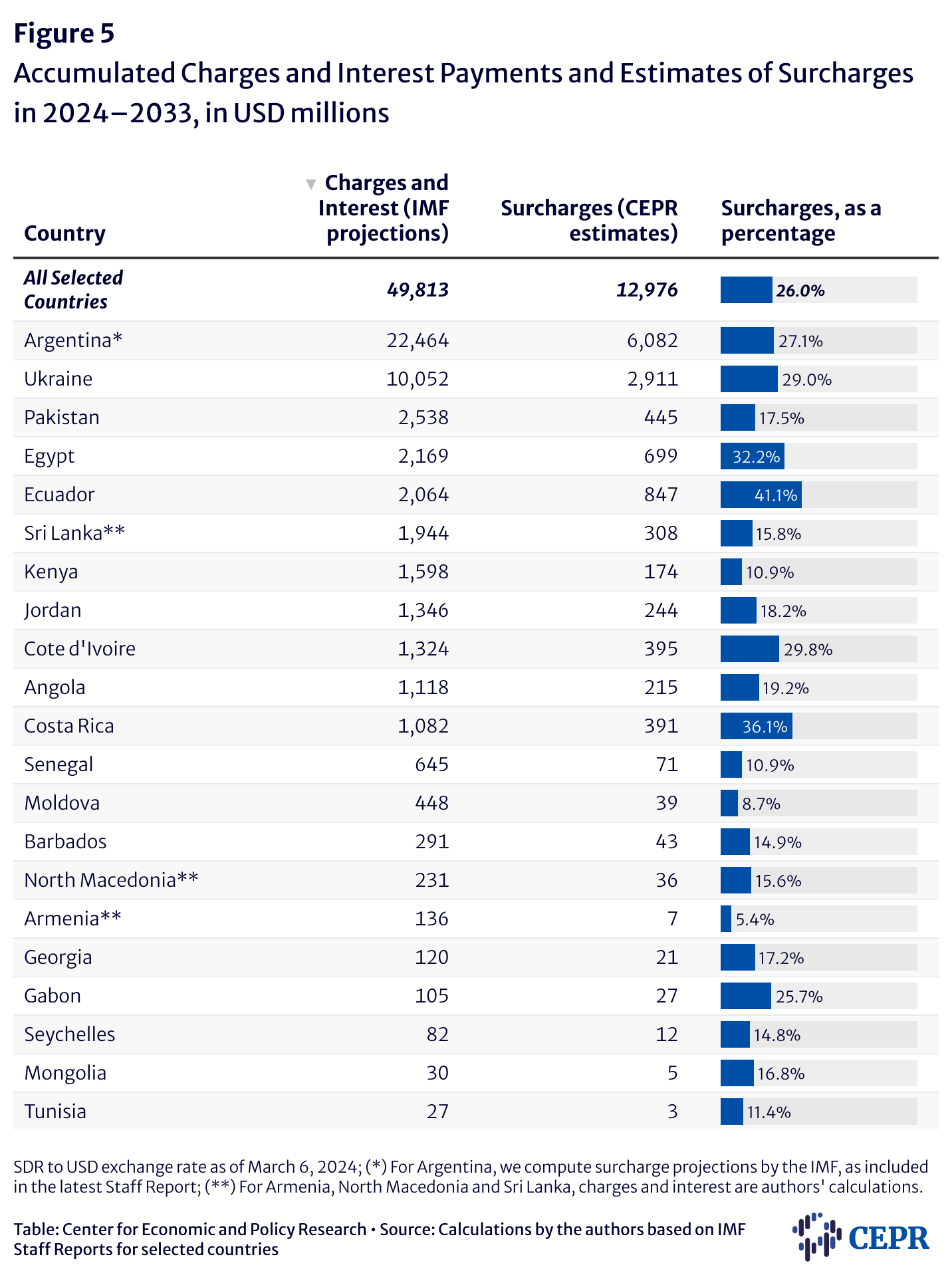

Surcharges can significantly increase the costs of borrowing from the Fund. On average, surcharges constitute 28 percent of the total “charges and interests,” as published in the IMF staff reports, for surcharge-paying countries from 2024 to 2033. For Ecuador, this figure reaches 41 percent (See Figure 5).

Our results support widespread concerns that the IMF’s surcharge policy presents a significant burden on heavily indebted countries. Furthermore, the net increase of six surcharge-paying countries since our previous update less than one year ago demonstrates that this burden is affecting an increasing number of countries and strongly suggests that surcharges are not effective in achieving their purported goal of disincentivizing reliance on IMF lending. In effect, the IMF is profiting from the fact that countries have been forced to turn to the Fund as a result of the COVID-19 crisis, subsequent monetary tightening, and other exogenous shocks.

In recent years, numerous world leaders, the G77 group of developing countries, UN officials, UN human rights experts, leading economists, civil society organizations, and more have called for the suspension or complete elimination of the IMF’s surcharge policy. The fact that the Fund has thus far failed to heed these calls is often attributed to the resistance of the US government, which exercises a major influence over policy decisions at the IMF. Members of the US Congress, however, have repeatedly urged surcharge reform, and in 2022, the House of Representatives passed legislation directing the US executive director at the IMF to support a review and suspension of the policy. Similar legislation, titled the Stop Onerous Surcharges Act, was introduced in April 2024.

Likely as a result of growing global and Congressional pressure, the IMF may be willing to consider reviewing its surcharge policy. In September 2023, Under Secretary for International Affairs Jay Shambaugh stated that the Treasury Department is “open to hearing views on surcharge policy reform.” The following month, the chair of the International Monetary and Financial Committee, Nadia Calviño, said that the Fund “will consider a review of surcharge policies.”

As the 2024 IMF Spring Meetings, scheduled for April 19-21, approach, the evidence is clearer than ever that the Biden administration should support efforts to reform or eliminate the Fund’s surcharge policy.

CEPR Estimates vs. IMF Official Projections

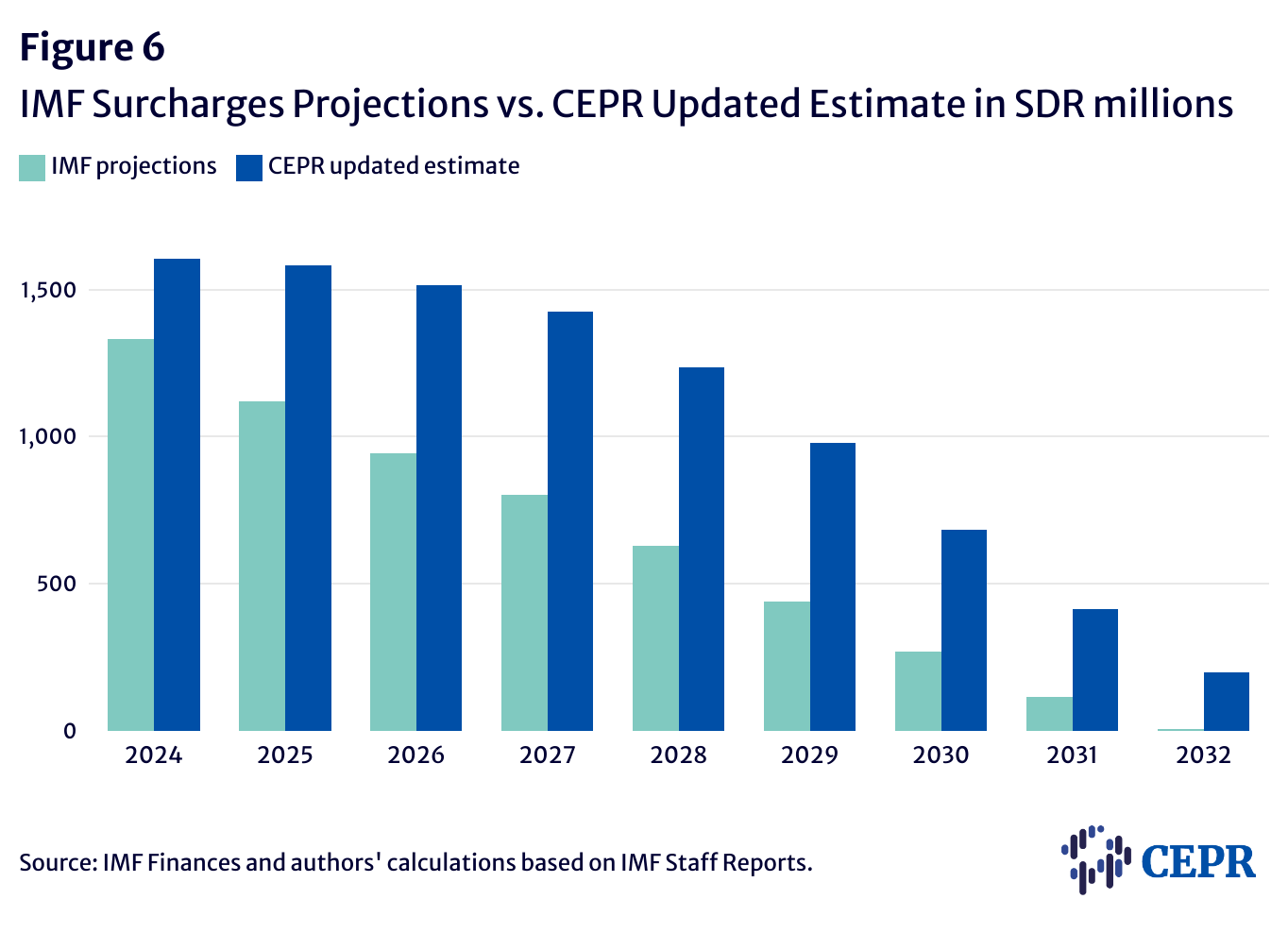

Our estimates of surcharge payments are, generally, significantly higher than the official projections that are now, as of 2023, published online via the IMF Financial Data Query Tool. As explained in the Methodology section, this is because the published IMF projections do not account for prospective credit, despite the fact that prospective credit is usually ultimately disbursed, even if the exact disbursement schedule often changes.

Our estimates for the 2024-2028 period are in total 53 percent higher than the official Fund projections (See Figure 6). In some cases, the difference between our estimates and the IMF’s projections is much more significant. Ukraine is an instructive example. Ukraine currently has 8.9 billion SDRs in total outstanding GRA credit. From 2024 to 2028, Ukraine is scheduled to receive another 8.3 billion SDRs in new GRA credit. By 2028, Ukraine’s “existing” stock of GRA credit is projected to be 2 billion SDRs, but its total “existing and prospective” stock is expected to be more than five times that, at 10.6 billion. Calculating surcharges based on the 2 billion SDRs in existing stock alone would be an extreme underestimate of Ukraine’s expected surcharge payments. Our projections for Ukraine’s future surcharge payments are therefore more than three times that of the Fund. Our estimates for Angola, in contrast, are quite close to those of the Fund, as Angola has no scheduled future disbursements.

As noted in the Methodology section, we base our estimates on publicly available data and a number of assumptions. However, we believe that these estimates provide a far more complete picture of countries’ actual future surcharge payments than the IMF’s limited published data. We encourage the IMF to provide its members and the general public with a more accurate picture of what surcharges are costing countries by publishing surcharge projections that include prospective credit.

Revised Methodology

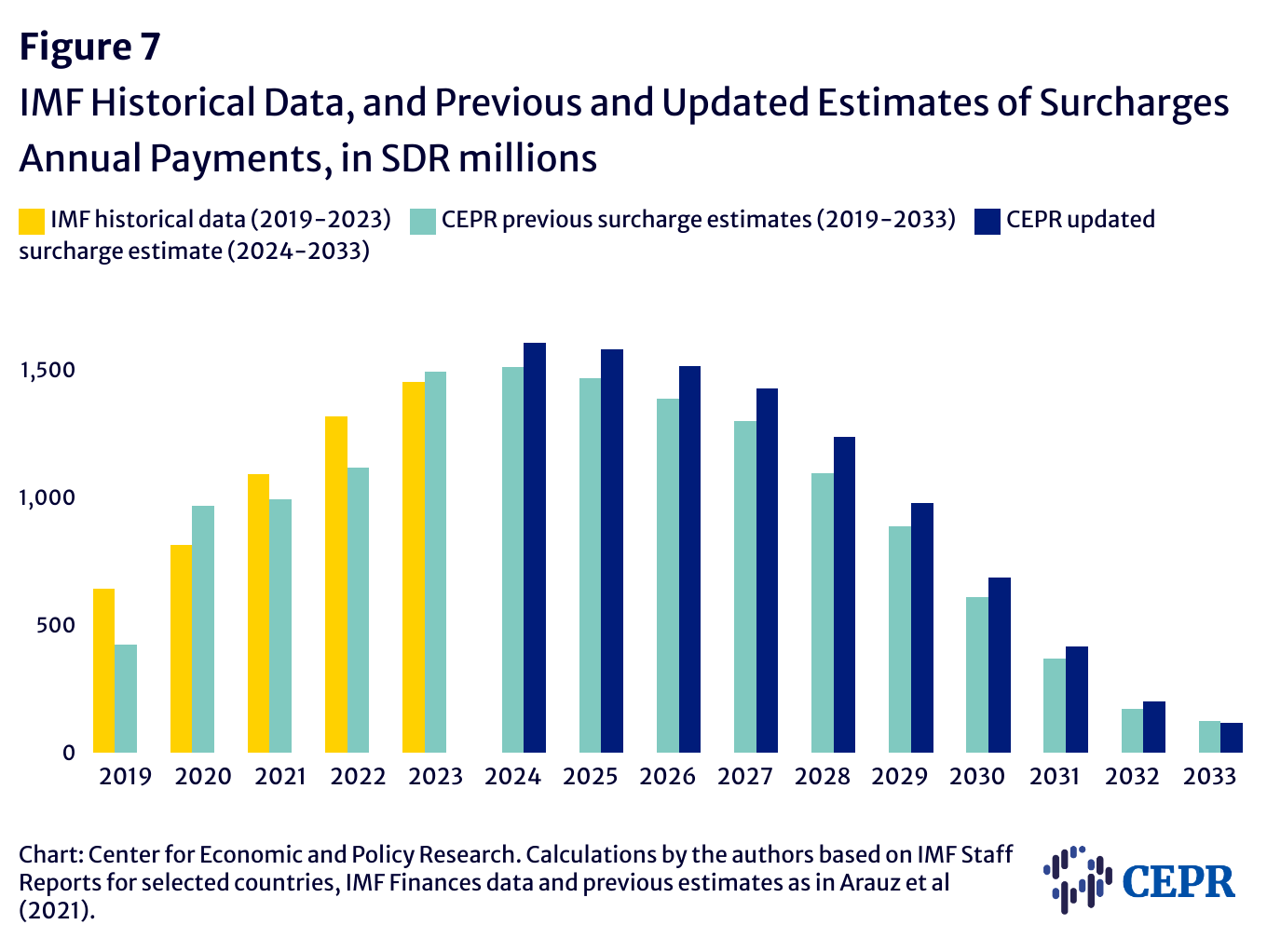

In this estimate update, we adjusted our methodology for calculating surcharge payments. We take into account net SDR charges and assessments, which we also subtract from all charges and interest in order to arrive at an estimate for surcharges. We apply the annual amount of SDR charges, interest, and assessments from the year of a staff report’s publication and use that amount as a projection for future-year estimates. The difference between our previous and updated estimates for 2024–2033, as shown in Figure 7 below, can thus be explained by the subtraction of SDR interest, charges, and assessments, as well as more recent data from newly available IMF staff reports.

We can now also compare IMF historical data on annual surcharge payments, which was made available in 2023, with our previous estimates. Despite variation in country-level predictions, over the 2019–2023 period, our estimates were, in total, a roughly 6 percent underestimate of actual. This tendency to underestimate is not unexpected, as we have consistently had to exclude at least one surcharge-paying country from our total estimates due to lack of data.