A friend called my attention to a piece by Dan Drezner disputing the current fashion that neo-liberalism is dead. Drezner makes several good points, and gets some important things wrong, but like most “neo-liberals” and critics of neo-liberalism, he still gets the basic story wrong.

The basic point that both sides miss here is that no one was actually committed to a free market without government intervention. The difference was that the so-called neo-liberals liked to claim that their policies were about the unfettered free market, whereas their opponents liked to claim that they were attacking the free market.

In reality, the neo-liberals were simply trying to structure the market in ways that redistributed income upward, while claiming that it was all the invisible hand of the market. Their opponents bizarrely chose to attack the market instead of the way the neo-liberals were shaping it. I’ll come back to this basic issue in a moment, but first it is worth dealing with a couple of key points that Drezner gets right and then a big one he gets badly wrong.

The most important point Drezner gets right is that we can’t reverse the hit from trade to manufacturing workers, and the larger group of workers without college degrees, by adopting protectionist policies now. There is now an extensive literature showing that the opening of trade to China and other developing countries led to a loss of millions of manufacturing jobs and downward pressure on the pay of the manufacturing jobs that remain.

Since manufacturing jobs had historically been a source of relatively good-paying jobs for workers (especially male workers) without college degrees, the loss of these jobs, and the wage premium in the ones that remained, put downward pressure on the wages of non-college-educated workers more generally. The wage premium in manufacturing has largely disappeared primarily as a result of the increased openness to trade in manufactured goods.

In 1980, according to data from the Bureau of Labor Statistics, the pay for production and non-supervisory workers was nearly 6.0 percent higher for manufacturing than in the rest of the private sector. In 2023 the pay of production and non-supervisory workers in manufacturing was 9.7 percent less than in the rest of the private sector. This is not a comprehensive measure of the wage premium in manufacturing since we would also have to add in benefits and adjust for factors like age, education, and location, but there is little doubt that the wage premium has fallen sharply in the last four decades.[1]

A big part of the explanation for the decline in the premium is the plunge in unionization rates in manufacturing. In 1980, 32.3 percent of workers in manufacturing were unionized, compared to 16.5 percent in the rest of the private sector. In 2023, 7.8 percent of manufacturing workers were unionized, only slightly higher than the 5.8 percent rate for the rest of the private sector.

The plunge in unionization rates among manufacturing workers largely explains the loss in the wage premium. However, this also reinforces Drezner’s point, there is little reason to focus on bringing back manufacturing jobs in a context where there is no reason to believe they will be especially good jobs.

In fairness to the Biden administration, it has tried to couple its protectionist measures with efforts to promote unionization of the jobs that are created. But it is not clear how successful these efforts will be. And, if it can succeed in promoting unionization in manufacturing then it may also be successful in promoting unionization in sectors like healthcare and retail.

In any case, the key to creating good-paying jobs in this story is that they be union jobs. There is no magic to manufacturing. The loss of good-paying jobs in manufacturing to trade was indeed a huge hit to the working class, but simply getting back manufacturing jobs will not be a gain.

The Resilient Supply Chain Mythology

One lesson that many took from the pandemic is that we need more domestic production to ensure that our supply chains are resilient. This view involves some major confusions.

First, many of the shortages of things like face masks and other protective equipment and ventilators, that appeared at the start of the pandemic, had nothing to do with supply chains. These were stockpile problems.

We could not suddenly produce hundreds of millions of masks or tens of thousands of ventilators even if these items were all produced in Ohio. We should have had substantial stockpiles on hand for the sort of emergency that COVID created. It was a major failing of the Trump administration that we had grossly inadequate stockpiles of these items.

The second point is that having domestic suppliers doesn’t guarantee resilience. We had many factories in the United States shut down at various points because of the pandemic. If we relied exclusively on domestic production, these shutdowns would have created major problems.

The key to having resilient supply chains is having diverse sources, both domestic and international. There is a good argument for not relying on a potentially hostile country like China for a key manufacturing input like semiconductors. But apart from a relatively small number of strategically important materials and manufactured inputs, there is little reason to equate a reliance on domestic production with resiliency. There is no reason to think we somehow would have fared better in the pandemic if all our manufactured goods were produced domestically.

The Cost of Making Workers Whole: What Drezner Gets Seriously Wrong

There is an ideology among supporters of our trade policy arguing that if we had just thrown out a few dollars for additional retraining or health care then we could have ensured that everyone came out ahead. This is a story of very bad arithmetic.

The median wage has increased by around 17 percent between 1980 and 2023. If it had kept pace with productivity, as it did between 1947 and 1973, it would have roughly doubled. The difference comes to around $15 an hour or $30,000 for a full-time full-year worker. If we say we had to make 60 million workers whole, the payments would be around $180 billion a year.

Of course, there were other factors than trade depressing wages. We also had a more anti-union National Labor Relations Board. We deregulated major sectors like airlines, trucking, and telecommunications, putting downward pressure on the wages of workers in these sectors. Suppose we say that 40 percent of the lost wages, or $76 billion a year, can be blamed on trade. That is two orders of magnitude larger than the amount of assistance approved by Congress.

This sort of trade assistance is simply not a plausible story. This is not just a case of an oversight where we forgot to compensate the losers from trade, it is a fantasy to imagine that anything like the assistance needed to make the losers whole would be politically feasible. Furthermore, as an economic matter, if we have the idea that we would raise this sort of money through taxes, the distortionary impact of these taxes would offset many of the gains from more open trade.

In short, making losers whole was not a serious possibility. The point of the trade policy pursued by the country over the last forty years was to redistribute income from the bottom half of the wage distribution to those in the top 10 or 20 percent. That is the result predicted by economic theory and that was the reality.

Neo-Liberalism is a Lie

The biggest problem in the debate over the demise of neo-liberalism is that it accepts a view that is obviously at odds with reality. Neo-liberalism was never about just leaving things to the market. That is an absurd proposition on its face. There is no market out there to leave things to, markets must be structured by policy. The debates over the last four decades were about how to structure markets, not whether to just leave things to the market.

Starting with trade, there was no big effort from so-called neo-liberals to open up trade in physicians’ services or the services of other highly paid professionals. This is not because increased trade in these services, by travel of physicians or patients or telemedicine is not possible, it is because these professionals have a lot of political power and could keep any discussion of lessening of the barriers that protect them off the political agenda. As a result, our doctors get paid twice as much as doctors in other wealthy countries. (Our manufacturing workers get paid considerably less.)

There is nothing about the market that tells us to subject manufacturing workers to competition with low-paid workers in the developing world and to protect the most highly paid professionals from the same sort of competition. That was a conscious policy with the predictable effect of increasing inequality.

Government-Granted Patent and Copyright Monopolies Are Not Given to Us by the Free Market

An even bigger area that the critics of imaginary neo-liberalism like to overlook is patent and copyright policy. We redistribute over $1 trillion annually in rents, close to half of after-tax corporate profits, due to these government-granted monopolies. In drugs alone the amount likely comes to over $500 billion annually, as we will spend over $600 billion this year for drugs that would likely sell for less than $100 billion in a free market without patent monopolies or related protections.

These government-granted monopolies also account for the bulk of the price in a number of other areas, including computers, software, smartphones, medical equipment, and of course video games and movies. It is almost Trumpian that anyone can look at an economy where government-granted monopolies play such a massive role in distribution and then pronounce it to be a free market without government intervention. It is even more absurd when we consider that the government plays a large role in creating the intellectual products subject to these monopolies, most notably with prescription drugs where it spends over $50 billion a year on biomedical research.

The Rules of Corporate Governance Are Not Given to Us by the Free Market

Corporate governance is another enormously important area where the critics of neo-liberalism apparently believe that detailed rules get written by the free market. It is common for people on the left to criticize the practice of share buybacks, at least in part on the basis that they allow top management to manipulate the market to maximize the value of their stock options.

If that claim is accurate, it effectively means that top corporate management is getting high pay by ripping off the companies they work for. After all, if the shareholders wanted CEOs and other top management to get higher pay, they could just give it to them.

The implication is that if shareholders had more control over the companies that they ostensibly own, CEOs would get lower pay. The current pattern persists because CEOs and top management largely control who gets on and stays on the corporate boards that determine their pay.

This is not just an issue of the pay of a small number of executives at the top of 500 or 1,000 major companies, the pay of top executives sets pay patterns throughout the economy. We would be in a very different world if CEO pay had roughly the same ratio to the pay of ordinary workers as it did fifty years ago. In that case, CEOs would be getting around $3 million a year rather than $30 million a year. And this change would have absolutely zero to do with a free market or government intervention, it is about writing different rules of corporate governance.

Financial Industry Bailouts Are Not Given to Us by the Free Market

In 2008, when the collapse of the housing bubble was sending shock waves through the financial system, the high priests of “neo-liberalism” ran to Congress and demanded a massive bailout to prevent a Second Great Depression. The risk of a Second Great Depression was of course a lie (we know the secret for getting out of a depression, it’s called “spending money”), but the point was that they were not yelling that we need to leave things to the market.

It’s not just the occasional bailout that pulls the government into the financial sector, the entire structure of the industry depends in very fundamental ways on the government, most obviously with deposit insurance and the Fed’s lending windows. Here too the interventions matter in a big way for inequality since many of the biggest fortunes in the country were made in the financial industry.

We could shape the industry in ways that make it less conducive to accumulating vast fortunes. For example, nothing about the free market says that we need to have special tax treatment, in the form of the carried interest tax deduction, for private equity and hedge fund partners, some of the richest people in the country. We also could look to ensure that the bankruptcy laws, often used by private equity funds in the firms they take over, are not a tool to rip off workers, suppliers, and other creditors.

And we could try to minimize the need for the financial sector by having the government perform tasks where a centralized entity is most efficient, like Social Security or health insurance. It is a simple truth of economics that an efficient financial sector is a small financial sector. Finance is an intermediate good like trucking. It is essential for the economy, but it does not provide a direct benefit to households like the healthcare or housing sectors. Believers in the free market should want to see the financial sector downsized, not the bloated financial sector we have today.

Section 230 Was Not Given to Us by the Free Market

Many progressives (and non-progressives) have complained about the power of huge social media platforms like Facebook, Twitter (now “X”), and TikTok. These platforms reach an order of magnitude more people than even the largest television stations or newspapers. Their moderation decisions are entirely at the whim of their owners, who also happen to be very rich.

The astounding growth of these platforms was not just the natural working of the market, although the network effects associated with online platforms are important. A major factor allowing for the growth of these platforms was the decision by Congress to exempt them from the same sort of liability for spreading defamatory material that print or broadcast outlets face.

If a television station or newspaper spread defamatory material statements, they would face legal liability, even if they did not originate them. This in fact was largely the story with Dominion’s suit against Fox. Much of the material cited in the suit was not from people paid by the network, but rather statements from guests on its news shows.

But Section 230 of the 1996 Communications Decency Act protects Internet platforms from liability for third-party content. This means that Mark Zuckerberg and Elon Musk can profit from spreading lies that would cost the New York Times or CNN millions in defamation suits.

It is often argued that it would be impossible for Internet platforms to screen the hundreds of millions of items posted every day. That is true, but they could face a takedown requirement after notification. They have managed to survive just fine with this sort of requirement with reference to copyright violations for a quarter century since the passage of the Millennial Copyright Act.

We can also structure a repeal in a way that is likely to favor smaller platforms, for example by allowing platforms that don’t sell ads or personal information to continue to enjoy Section 230 protection. In any case, it should be pretty obvious that Section 230 protection is not the free market. It was a decision by Congress to benefit Internet platforms relative to print and broadcast outlets. And it hugely facilitated the growth of giant Internet platforms.

The Death of Neo-Liberalism: Victory Over a Non-Existent Enemy

Like everyone else, I love a victory party, but it’s hard to get too excited over defeating an enemy that does not exist. The Biden administration has adopted many progressive economic policies. Its ambitious recovery package quickly got the economy back to full employment, which also led to large wage gains for the lowest-paid workers.

It has also pushed forward with a major infrastructure program, and the Inflation Reduction Act is by far the most aggressive climate legislation ever passed in the U.S. It also has taken steps to rein in patent monopoly pricing for prescription drugs. And for the first time in decades, we have an administration that takes anti-trust policy seriously. In addition, it has made the terms for buying into the exchanges created by the Affordable Care Act far more generous, and crafted an income-driven student loan repayment plan that should mean that this debt is not a major burden.

All of these are positive developments, which can be built upon in a second Biden administration. But they have nothing to do with defeating neo-liberalism.

If we want to make serious progress in advancing progressive economic policies, we need to have a clear idea of what we are fighting. The idea that we were fighting against the free market is absurd on its face.

The market is a tool, like the wheel. It would be as absurd to have a fight against the market as a fight against the wheel. The problem is not the market, but rather a set of policies that the right has used to structure the market to redistribute income upward. We need to attack those policies, not celebrate a victory over an imaginary foe. (Yes, I am talking my book, Rigged [it’s free].)

[1] Larry Mishel has a fuller analysis which also shows a sharp decline, but still finds a substantial wage premium, although the analysis ends with the period 2010-2016, missing any declines in the subsequent seven years.

A friend called my attention to a piece by Dan Drezner disputing the current fashion that neo-liberalism is dead. Drezner makes several good points, and gets some important things wrong, but like most “neo-liberals” and critics of neo-liberalism, he still gets the basic story wrong.

The basic point that both sides miss here is that no one was actually committed to a free market without government intervention. The difference was that the so-called neo-liberals liked to claim that their policies were about the unfettered free market, whereas their opponents liked to claim that they were attacking the free market.

In reality, the neo-liberals were simply trying to structure the market in ways that redistributed income upward, while claiming that it was all the invisible hand of the market. Their opponents bizarrely chose to attack the market instead of the way the neo-liberals were shaping it. I’ll come back to this basic issue in a moment, but first it is worth dealing with a couple of key points that Drezner gets right and then a big one he gets badly wrong.

The most important point Drezner gets right is that we can’t reverse the hit from trade to manufacturing workers, and the larger group of workers without college degrees, by adopting protectionist policies now. There is now an extensive literature showing that the opening of trade to China and other developing countries led to a loss of millions of manufacturing jobs and downward pressure on the pay of the manufacturing jobs that remain.

Since manufacturing jobs had historically been a source of relatively good-paying jobs for workers (especially male workers) without college degrees, the loss of these jobs, and the wage premium in the ones that remained, put downward pressure on the wages of non-college-educated workers more generally. The wage premium in manufacturing has largely disappeared primarily as a result of the increased openness to trade in manufactured goods.

In 1980, according to data from the Bureau of Labor Statistics, the pay for production and non-supervisory workers was nearly 6.0 percent higher for manufacturing than in the rest of the private sector. In 2023 the pay of production and non-supervisory workers in manufacturing was 9.7 percent less than in the rest of the private sector. This is not a comprehensive measure of the wage premium in manufacturing since we would also have to add in benefits and adjust for factors like age, education, and location, but there is little doubt that the wage premium has fallen sharply in the last four decades.[1]

A big part of the explanation for the decline in the premium is the plunge in unionization rates in manufacturing. In 1980, 32.3 percent of workers in manufacturing were unionized, compared to 16.5 percent in the rest of the private sector. In 2023, 7.8 percent of manufacturing workers were unionized, only slightly higher than the 5.8 percent rate for the rest of the private sector.

The plunge in unionization rates among manufacturing workers largely explains the loss in the wage premium. However, this also reinforces Drezner’s point, there is little reason to focus on bringing back manufacturing jobs in a context where there is no reason to believe they will be especially good jobs.

In fairness to the Biden administration, it has tried to couple its protectionist measures with efforts to promote unionization of the jobs that are created. But it is not clear how successful these efforts will be. And, if it can succeed in promoting unionization in manufacturing then it may also be successful in promoting unionization in sectors like healthcare and retail.

In any case, the key to creating good-paying jobs in this story is that they be union jobs. There is no magic to manufacturing. The loss of good-paying jobs in manufacturing to trade was indeed a huge hit to the working class, but simply getting back manufacturing jobs will not be a gain.

The Resilient Supply Chain Mythology

One lesson that many took from the pandemic is that we need more domestic production to ensure that our supply chains are resilient. This view involves some major confusions.

First, many of the shortages of things like face masks and other protective equipment and ventilators, that appeared at the start of the pandemic, had nothing to do with supply chains. These were stockpile problems.

We could not suddenly produce hundreds of millions of masks or tens of thousands of ventilators even if these items were all produced in Ohio. We should have had substantial stockpiles on hand for the sort of emergency that COVID created. It was a major failing of the Trump administration that we had grossly inadequate stockpiles of these items.

The second point is that having domestic suppliers doesn’t guarantee resilience. We had many factories in the United States shut down at various points because of the pandemic. If we relied exclusively on domestic production, these shutdowns would have created major problems.

The key to having resilient supply chains is having diverse sources, both domestic and international. There is a good argument for not relying on a potentially hostile country like China for a key manufacturing input like semiconductors. But apart from a relatively small number of strategically important materials and manufactured inputs, there is little reason to equate a reliance on domestic production with resiliency. There is no reason to think we somehow would have fared better in the pandemic if all our manufactured goods were produced domestically.

The Cost of Making Workers Whole: What Drezner Gets Seriously Wrong

There is an ideology among supporters of our trade policy arguing that if we had just thrown out a few dollars for additional retraining or health care then we could have ensured that everyone came out ahead. This is a story of very bad arithmetic.

The median wage has increased by around 17 percent between 1980 and 2023. If it had kept pace with productivity, as it did between 1947 and 1973, it would have roughly doubled. The difference comes to around $15 an hour or $30,000 for a full-time full-year worker. If we say we had to make 60 million workers whole, the payments would be around $180 billion a year.

Of course, there were other factors than trade depressing wages. We also had a more anti-union National Labor Relations Board. We deregulated major sectors like airlines, trucking, and telecommunications, putting downward pressure on the wages of workers in these sectors. Suppose we say that 40 percent of the lost wages, or $76 billion a year, can be blamed on trade. That is two orders of magnitude larger than the amount of assistance approved by Congress.

This sort of trade assistance is simply not a plausible story. This is not just a case of an oversight where we forgot to compensate the losers from trade, it is a fantasy to imagine that anything like the assistance needed to make the losers whole would be politically feasible. Furthermore, as an economic matter, if we have the idea that we would raise this sort of money through taxes, the distortionary impact of these taxes would offset many of the gains from more open trade.

In short, making losers whole was not a serious possibility. The point of the trade policy pursued by the country over the last forty years was to redistribute income from the bottom half of the wage distribution to those in the top 10 or 20 percent. That is the result predicted by economic theory and that was the reality.

Neo-Liberalism is a Lie

The biggest problem in the debate over the demise of neo-liberalism is that it accepts a view that is obviously at odds with reality. Neo-liberalism was never about just leaving things to the market. That is an absurd proposition on its face. There is no market out there to leave things to, markets must be structured by policy. The debates over the last four decades were about how to structure markets, not whether to just leave things to the market.

Starting with trade, there was no big effort from so-called neo-liberals to open up trade in physicians’ services or the services of other highly paid professionals. This is not because increased trade in these services, by travel of physicians or patients or telemedicine is not possible, it is because these professionals have a lot of political power and could keep any discussion of lessening of the barriers that protect them off the political agenda. As a result, our doctors get paid twice as much as doctors in other wealthy countries. (Our manufacturing workers get paid considerably less.)

There is nothing about the market that tells us to subject manufacturing workers to competition with low-paid workers in the developing world and to protect the most highly paid professionals from the same sort of competition. That was a conscious policy with the predictable effect of increasing inequality.

Government-Granted Patent and Copyright Monopolies Are Not Given to Us by the Free Market

An even bigger area that the critics of imaginary neo-liberalism like to overlook is patent and copyright policy. We redistribute over $1 trillion annually in rents, close to half of after-tax corporate profits, due to these government-granted monopolies. In drugs alone the amount likely comes to over $500 billion annually, as we will spend over $600 billion this year for drugs that would likely sell for less than $100 billion in a free market without patent monopolies or related protections.

These government-granted monopolies also account for the bulk of the price in a number of other areas, including computers, software, smartphones, medical equipment, and of course video games and movies. It is almost Trumpian that anyone can look at an economy where government-granted monopolies play such a massive role in distribution and then pronounce it to be a free market without government intervention. It is even more absurd when we consider that the government plays a large role in creating the intellectual products subject to these monopolies, most notably with prescription drugs where it spends over $50 billion a year on biomedical research.

The Rules of Corporate Governance Are Not Given to Us by the Free Market

Corporate governance is another enormously important area where the critics of neo-liberalism apparently believe that detailed rules get written by the free market. It is common for people on the left to criticize the practice of share buybacks, at least in part on the basis that they allow top management to manipulate the market to maximize the value of their stock options.

If that claim is accurate, it effectively means that top corporate management is getting high pay by ripping off the companies they work for. After all, if the shareholders wanted CEOs and other top management to get higher pay, they could just give it to them.

The implication is that if shareholders had more control over the companies that they ostensibly own, CEOs would get lower pay. The current pattern persists because CEOs and top management largely control who gets on and stays on the corporate boards that determine their pay.

This is not just an issue of the pay of a small number of executives at the top of 500 or 1,000 major companies, the pay of top executives sets pay patterns throughout the economy. We would be in a very different world if CEO pay had roughly the same ratio to the pay of ordinary workers as it did fifty years ago. In that case, CEOs would be getting around $3 million a year rather than $30 million a year. And this change would have absolutely zero to do with a free market or government intervention, it is about writing different rules of corporate governance.

Financial Industry Bailouts Are Not Given to Us by the Free Market

In 2008, when the collapse of the housing bubble was sending shock waves through the financial system, the high priests of “neo-liberalism” ran to Congress and demanded a massive bailout to prevent a Second Great Depression. The risk of a Second Great Depression was of course a lie (we know the secret for getting out of a depression, it’s called “spending money”), but the point was that they were not yelling that we need to leave things to the market.

It’s not just the occasional bailout that pulls the government into the financial sector, the entire structure of the industry depends in very fundamental ways on the government, most obviously with deposit insurance and the Fed’s lending windows. Here too the interventions matter in a big way for inequality since many of the biggest fortunes in the country were made in the financial industry.

We could shape the industry in ways that make it less conducive to accumulating vast fortunes. For example, nothing about the free market says that we need to have special tax treatment, in the form of the carried interest tax deduction, for private equity and hedge fund partners, some of the richest people in the country. We also could look to ensure that the bankruptcy laws, often used by private equity funds in the firms they take over, are not a tool to rip off workers, suppliers, and other creditors.

And we could try to minimize the need for the financial sector by having the government perform tasks where a centralized entity is most efficient, like Social Security or health insurance. It is a simple truth of economics that an efficient financial sector is a small financial sector. Finance is an intermediate good like trucking. It is essential for the economy, but it does not provide a direct benefit to households like the healthcare or housing sectors. Believers in the free market should want to see the financial sector downsized, not the bloated financial sector we have today.

Section 230 Was Not Given to Us by the Free Market

Many progressives (and non-progressives) have complained about the power of huge social media platforms like Facebook, Twitter (now “X”), and TikTok. These platforms reach an order of magnitude more people than even the largest television stations or newspapers. Their moderation decisions are entirely at the whim of their owners, who also happen to be very rich.

The astounding growth of these platforms was not just the natural working of the market, although the network effects associated with online platforms are important. A major factor allowing for the growth of these platforms was the decision by Congress to exempt them from the same sort of liability for spreading defamatory material that print or broadcast outlets face.

If a television station or newspaper spread defamatory material statements, they would face legal liability, even if they did not originate them. This in fact was largely the story with Dominion’s suit against Fox. Much of the material cited in the suit was not from people paid by the network, but rather statements from guests on its news shows.

But Section 230 of the 1996 Communications Decency Act protects Internet platforms from liability for third-party content. This means that Mark Zuckerberg and Elon Musk can profit from spreading lies that would cost the New York Times or CNN millions in defamation suits.

It is often argued that it would be impossible for Internet platforms to screen the hundreds of millions of items posted every day. That is true, but they could face a takedown requirement after notification. They have managed to survive just fine with this sort of requirement with reference to copyright violations for a quarter century since the passage of the Millennial Copyright Act.

We can also structure a repeal in a way that is likely to favor smaller platforms, for example by allowing platforms that don’t sell ads or personal information to continue to enjoy Section 230 protection. In any case, it should be pretty obvious that Section 230 protection is not the free market. It was a decision by Congress to benefit Internet platforms relative to print and broadcast outlets. And it hugely facilitated the growth of giant Internet platforms.

The Death of Neo-Liberalism: Victory Over a Non-Existent Enemy

Like everyone else, I love a victory party, but it’s hard to get too excited over defeating an enemy that does not exist. The Biden administration has adopted many progressive economic policies. Its ambitious recovery package quickly got the economy back to full employment, which also led to large wage gains for the lowest-paid workers.

It has also pushed forward with a major infrastructure program, and the Inflation Reduction Act is by far the most aggressive climate legislation ever passed in the U.S. It also has taken steps to rein in patent monopoly pricing for prescription drugs. And for the first time in decades, we have an administration that takes anti-trust policy seriously. In addition, it has made the terms for buying into the exchanges created by the Affordable Care Act far more generous, and crafted an income-driven student loan repayment plan that should mean that this debt is not a major burden.

All of these are positive developments, which can be built upon in a second Biden administration. But they have nothing to do with defeating neo-liberalism.

If we want to make serious progress in advancing progressive economic policies, we need to have a clear idea of what we are fighting. The idea that we were fighting against the free market is absurd on its face.

The market is a tool, like the wheel. It would be as absurd to have a fight against the market as a fight against the wheel. The problem is not the market, but rather a set of policies that the right has used to structure the market to redistribute income upward. We need to attack those policies, not celebrate a victory over an imaginary foe. (Yes, I am talking my book, Rigged [it’s free].)

[1] Larry Mishel has a fuller analysis which also shows a sharp decline, but still finds a substantial wage premium, although the analysis ends with the period 2010-2016, missing any declines in the subsequent seven years.

Read More Leer más Join the discussion Participa en la discusión

I have a lot of respect for Ro Khanna. He is an articulate and energetic progressive from the belly of the beast, Silicon Valley. I also appreciate the sentiments behind his latest op-ed in the NYT on how we should seek to ensure that the benefits from AI are broadly shared. However, he badly errors in his framing of the issue and description of recent economic policy.

Khanna describes our policy on trade in the 1990s:

“Today the Democratic Party is at a crossroads, as it was in the 1990s, when the dominant wing in the party argued for prioritizing private-sector growth and letting the chips fall where they may. The criticism of this approach offered around that time by Senator Paul Wellstone, Senator Russ Feingold and Representative Bernie Sanders (as he was then) — that the offshoring globalization debacle was not helping the working class and was, in fact, hurting it — was largely ignored.”

It is wrong to say that our trade policy was “letting the chips fall where they may.” It was in fact far worse.

The policy was to deliberately subject manufacturing workers to competition with the low paid workers in the developing world. This had the predicted and actual effect of eliminating millions of manufacturing jobs and lowering the wages of manufacturing workers in the jobs that remained. Furthermore, since manufacturing had historically been a source of high-paid employment for workers without college degrees, this put downward pressure on the pay of less-educated workers more generally.

At the same time that we were using trade policy to depress the wages of less-educated workers, we continued to leave protections in place for more highly educated workers like doctors and dentists. We also increased protections in the form of patent and copyright monopolies, which we made stronger and longer both in domestic policy and internationally through trade agreements. This raised the profits and the wages of those in a position to benefit from these monopolies.

It is a gross misrepresentation to say that the government policy in this period was just leaving things to the market, it was a deliberate policy of upward redistribution. It is also important to recognize that most of the upward redistribution was within the wage distribution, not to profits. The profit share of national income changed little from 1980 to 2000, at which point most of the upward redistribution had already taken place.

The big gainers from the upward redistribution were high-end professionals, well-placed STEM workers, Wall Street types, and high-level corporate executives. We need to recognize this fact if we want to structure the benefits from AI in ways that lead to broadly based gains.

AI does offer enormous potential in this way. For example, AI could allow a trained healthcare professional, like a nurse practitioner or a physician’s assistant, to make diagnoses as well or better than doctors. AI could also replace many of the higher paid workers in various STEM professions, like drug development. If we don’t allow research findings to be bottled up with government-granted patent rights or other protections, AI could benefit the bulk of the population by giving us lower cost health care and legal services, in addition to savings in many other areas.

The key point here is to recognize that policy has always consciously directed trade and technology. It is to the benefit of the winners to pretend that the upward redistribution of the last four decades was “letting the chips fall where they may,” but that is not the reality. And, they won’t let you say that in the New York Times.

I have a lot of respect for Ro Khanna. He is an articulate and energetic progressive from the belly of the beast, Silicon Valley. I also appreciate the sentiments behind his latest op-ed in the NYT on how we should seek to ensure that the benefits from AI are broadly shared. However, he badly errors in his framing of the issue and description of recent economic policy.

Khanna describes our policy on trade in the 1990s:

“Today the Democratic Party is at a crossroads, as it was in the 1990s, when the dominant wing in the party argued for prioritizing private-sector growth and letting the chips fall where they may. The criticism of this approach offered around that time by Senator Paul Wellstone, Senator Russ Feingold and Representative Bernie Sanders (as he was then) — that the offshoring globalization debacle was not helping the working class and was, in fact, hurting it — was largely ignored.”

It is wrong to say that our trade policy was “letting the chips fall where they may.” It was in fact far worse.

The policy was to deliberately subject manufacturing workers to competition with the low paid workers in the developing world. This had the predicted and actual effect of eliminating millions of manufacturing jobs and lowering the wages of manufacturing workers in the jobs that remained. Furthermore, since manufacturing had historically been a source of high-paid employment for workers without college degrees, this put downward pressure on the pay of less-educated workers more generally.

At the same time that we were using trade policy to depress the wages of less-educated workers, we continued to leave protections in place for more highly educated workers like doctors and dentists. We also increased protections in the form of patent and copyright monopolies, which we made stronger and longer both in domestic policy and internationally through trade agreements. This raised the profits and the wages of those in a position to benefit from these monopolies.

It is a gross misrepresentation to say that the government policy in this period was just leaving things to the market, it was a deliberate policy of upward redistribution. It is also important to recognize that most of the upward redistribution was within the wage distribution, not to profits. The profit share of national income changed little from 1980 to 2000, at which point most of the upward redistribution had already taken place.

The big gainers from the upward redistribution were high-end professionals, well-placed STEM workers, Wall Street types, and high-level corporate executives. We need to recognize this fact if we want to structure the benefits from AI in ways that lead to broadly based gains.

AI does offer enormous potential in this way. For example, AI could allow a trained healthcare professional, like a nurse practitioner or a physician’s assistant, to make diagnoses as well or better than doctors. AI could also replace many of the higher paid workers in various STEM professions, like drug development. If we don’t allow research findings to be bottled up with government-granted patent rights or other protections, AI could benefit the bulk of the population by giving us lower cost health care and legal services, in addition to savings in many other areas.

The key point here is to recognize that policy has always consciously directed trade and technology. It is to the benefit of the winners to pretend that the upward redistribution of the last four decades was “letting the chips fall where they may,” but that is not the reality. And, they won’t let you say that in the New York Times.

Read More Leer más Join the discussion Participa en la discusión

In the NYT’s Morning Newsletter, German Lopez told readers that “the debt matters again.” The story is that the economy has changed so now we have to get seriously worried about the size of the government debt. He gives us three reasons:

While these claims have some basis in reality, they don’t make the case for the immediate action he urges in the piece.

On the first point, higher interest rates do mean higher interest payments, but the rise is not as sharp as he claims and even with higher rates we are still looking at much lower interest rates than we saw in the late 1990s, when the government was running budget surpluses.

The current real interest rate is around 1.7 percent. That is about a percentage point higher than it was in the years just before the pandemic, but almost two percentage points below where it was in the late 1990s. This hardly seems like a cause for great concern.

The second and third points should really be taken together. The point is that the economy is now operating near its capacity, it does not need the boost from large deficits to sustain high levels of employment, and in fact, this boost may now spur inflation.

While the first part is true, it is not clear how much we could reduce the deficit without seeing an impact on employment and output. For example, if we had a $270 billion dollar annual increase in taxes (or cut in spending), approximately 1.0 percent of GDP, it is likely that it would substantially slow growth and lead to some increase in unemployment.

As we saw with the Fed’s recent rate hikes, the economy is far less sensitive to interest rates than many of us had believed. This means that even if the Fed responded to the prospect of smaller deficits by aggressively lowering rates, it may not be able to offset the hit to demand. We may still see the economy slow and unemployment rise.

This brings us to the inflation side of the equation. The most recent inflation reports indicate that inflation is coming down to a pace consistent with the Fed’s 2.0 percent target. This means that current levels of deficit spending are not leading to inflation. Therefore, there should be little urgency in reducing them.

What About Implicit Debt Created by Government-Granted Patent and Copyright Monopolies?

In keeping with its quasi-religious commitment to ignore the implicit debt created by government-granted patent and copyright monopolies, Lopez makes no mention of them in this piece. The point here is straightforward. The government can pay for innovation and creative work through direct spending, as it already does to a substantial extent, for example, by spending over $50 billion a year on biomedical research through the National Institutes of Health.

Alternatively, it can pay for innovation and creative work by granting patent and copyright monopolies, threatening to arrest people who sell items that compete with new innovations or creative work. I previously compared granting patent and copyright monopolies to the practice of tax farming, selling off the right to collect taxes, which was a common practice in pre-revolutionary France and elsewhere.

The German Lopezes of the world, who yell about the debt, would presumably be fine with tax farming, since it doesn’t increase the debt by a dime. In fact, it reduces the debt, since the payments the government collects for selling off the right to collect future taxes means lower deficits, and therefore a lower debt.

In the same vein, these people insist on ignoring the implications of granting patent and copyright monopolies, which likely now lead to patent rents in excess of $1 trillion a year. In fact, since the government pays part of these rents, most notably with prescription drugs through Medicare, Medicaid, and other government programs, the parceling out of these monopolies directly raises the government debt.

Nonetheless, the deficit hawks somehow can’t see them. This is hard to understand since they are not obviously stupid people. Perhaps it is because they like the people who receive these rents, people like Bill Gates and the folks who own and work at the drug companies, more than they like the people who benefit from most government spending. But that would just be speculation.

Anyhow, if we want to have a serious discussion of the impact of the government debt on the economy it has to include a discussion of the impact of government-granted patent and copyright monopolies. Otherwise, it is just about pushing an agenda.

In the NYT’s Morning Newsletter, German Lopez told readers that “the debt matters again.” The story is that the economy has changed so now we have to get seriously worried about the size of the government debt. He gives us three reasons:

While these claims have some basis in reality, they don’t make the case for the immediate action he urges in the piece.

On the first point, higher interest rates do mean higher interest payments, but the rise is not as sharp as he claims and even with higher rates we are still looking at much lower interest rates than we saw in the late 1990s, when the government was running budget surpluses.

The current real interest rate is around 1.7 percent. That is about a percentage point higher than it was in the years just before the pandemic, but almost two percentage points below where it was in the late 1990s. This hardly seems like a cause for great concern.

The second and third points should really be taken together. The point is that the economy is now operating near its capacity, it does not need the boost from large deficits to sustain high levels of employment, and in fact, this boost may now spur inflation.

While the first part is true, it is not clear how much we could reduce the deficit without seeing an impact on employment and output. For example, if we had a $270 billion dollar annual increase in taxes (or cut in spending), approximately 1.0 percent of GDP, it is likely that it would substantially slow growth and lead to some increase in unemployment.

As we saw with the Fed’s recent rate hikes, the economy is far less sensitive to interest rates than many of us had believed. This means that even if the Fed responded to the prospect of smaller deficits by aggressively lowering rates, it may not be able to offset the hit to demand. We may still see the economy slow and unemployment rise.

This brings us to the inflation side of the equation. The most recent inflation reports indicate that inflation is coming down to a pace consistent with the Fed’s 2.0 percent target. This means that current levels of deficit spending are not leading to inflation. Therefore, there should be little urgency in reducing them.

What About Implicit Debt Created by Government-Granted Patent and Copyright Monopolies?

In keeping with its quasi-religious commitment to ignore the implicit debt created by government-granted patent and copyright monopolies, Lopez makes no mention of them in this piece. The point here is straightforward. The government can pay for innovation and creative work through direct spending, as it already does to a substantial extent, for example, by spending over $50 billion a year on biomedical research through the National Institutes of Health.

Alternatively, it can pay for innovation and creative work by granting patent and copyright monopolies, threatening to arrest people who sell items that compete with new innovations or creative work. I previously compared granting patent and copyright monopolies to the practice of tax farming, selling off the right to collect taxes, which was a common practice in pre-revolutionary France and elsewhere.

The German Lopezes of the world, who yell about the debt, would presumably be fine with tax farming, since it doesn’t increase the debt by a dime. In fact, it reduces the debt, since the payments the government collects for selling off the right to collect future taxes means lower deficits, and therefore a lower debt.

In the same vein, these people insist on ignoring the implications of granting patent and copyright monopolies, which likely now lead to patent rents in excess of $1 trillion a year. In fact, since the government pays part of these rents, most notably with prescription drugs through Medicare, Medicaid, and other government programs, the parceling out of these monopolies directly raises the government debt.

Nonetheless, the deficit hawks somehow can’t see them. This is hard to understand since they are not obviously stupid people. Perhaps it is because they like the people who receive these rents, people like Bill Gates and the folks who own and work at the drug companies, more than they like the people who benefit from most government spending. But that would just be speculation.

Anyhow, if we want to have a serious discussion of the impact of the government debt on the economy it has to include a discussion of the impact of government-granted patent and copyright monopolies. Otherwise, it is just about pushing an agenda.

Read More Leer más Join the discussion Participa en la discusión

It may not qualify as “The Big Lie,” but the media feel the need to constantly claim that young people can no longer afford to buy homes. The latest salvo is the Washington Post telling how young people have to live with their parents to save money for a down payment:

“The trade-off comes down to temporarily relinquishing a measure of independence to achieve a milestone increasingly out of reach for people their age.”

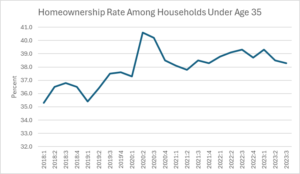

This is not true. Homeownership rates for people under age 35 are actually above their pre-pandemic level.

Source: Census Bureau, Table 6.

It is undoubtedly true that the jump in mortgage interest rates in the last year and a half has made it more difficult for young people to buy homes, but many young people bought homes before rates rose. It also appears that mortgage rates are now falling again. They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.

It may not qualify as “The Big Lie,” but the media feel the need to constantly claim that young people can no longer afford to buy homes. The latest salvo is the Washington Post telling how young people have to live with their parents to save money for a down payment:

“The trade-off comes down to temporarily relinquishing a measure of independence to achieve a milestone increasingly out of reach for people their age.”

This is not true. Homeownership rates for people under age 35 are actually above their pre-pandemic level.

Source: Census Bureau, Table 6.

It is undoubtedly true that the jump in mortgage interest rates in the last year and a half has made it more difficult for young people to buy homes, but many young people bought homes before rates rose. It also appears that mortgage rates are now falling again. They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.

Read More Leer más Join the discussion Participa en la discusión

It is amazing how ideology can be so thick that it prevents even highly educated people from thinking clearly. We saw this fact on display in a Washington Post piece on prescription drug prices by its columnist Bina Venkataraman.

Venkataraman points out that we are seeing great advances in developing new drugs and treatments, but many of these innovations are selling for ridiculous prices. Her lead example is Casgevy, a treatment that can cure sickle cell anemia. The developer of this treatment is charging $2.2 million for it.

She argues that the price could be radically reduced if the research was funded at least in part by non-profits, governments, or companies willing to accept lower rates of return. This is of course true, but her ideology prevents her from seeing clearly the issues involved.

After arguing for developing drugs in ways that allow for lower prices, she asserts in the last paragraph:

“But there are steep costs to letting the market determine what’s best for a society’s well-being.”

The whole point here is that we are not letting the market determine what’s best for a society’s well-being. We, or our politicians, have decided that they want to grant lengthy and strong patent monopolies as a way to encourage companies to innovate.

This is not just a point of semantics. Granting patent monopolies is a policy choice, it is not a natural feature of the market. These monopolies are a way that the government has chosen to finance innovation. If we argue against patent monopolies, we are not arguing against letting the market decide how resources should be allocated, we are arguing against using this specific government mechanism for determining the way resources are allocated.

There is a very good argument against the patent monopoly system for financing prescription drug development. The obvious one, as Venkataraman points out, is that these monopolies can lead to ridiculously high prices for drugs and treatments.

This is for the obvious reason that people with the resources, either their own money or access to good insurance, are willing to pay huge amounts to preserve their health or save their life. But these high prices are almost entirely due to the patent monopoly. Water is also necessary for our life and health, but it is usually reasonably cheap, since there are not monopolies on it.

In the case of prescription drugs, it is almost always cheap to manufacture and distribute them. In a free market, they would generally sell for less than ten percent of the price of drugs subject to patent monopolies and often less than one percent. It generally would not be a major problem to pay for drugs, if they were available in a free market without patent monopolies.

While the world’s poor would find even generic prices expensive, if drugs were sold at free market prices, aid agencies and private charities could realistically look to cover the cost, as has been the case with AIDS drugs in Sub-Saharan Africa. In some cases, as with Casgevy, the price involves paying trained medical professionals to provide a treatment. This is a cost that would still be faced even without the patent monopolies, but the expense would be far more manageable.

Patent Monopolies Provide Incentives to Lie

When drug companies can sell their products for mark-ups of several hundred percent, or even several thousand percent, they have enormous incentive to push their drugs as widely as possible. This means exaggerating the potential benefits and also minimizing the side effects and risks associated with their drugs.

The extreme case of this lying was the opioid crisis, where drug manufacturers knew that their drugs were highly addictive and pushed them with the claim that they were not. This led to far more abuse, which ruined the lives of hundreds of thousands of people.

While opioids are an extreme case, drug companies routinely pay doctors to promote their products and lobby politicians and government agencies to have their drugs used as widely as possible. To take a prominent recent example, through intensive lobbying Biogen got the FDA to approve its Alzheimer’s drug Aduhelm, over the objections of its independent advisory panel.

The drug’s trials showed little evidence of effectiveness and serious side effects. The decision was later reversed. If Aduhelm was being sold as a low-cost generic, there would have been little incentive to push a drug in a situation where the evidence did not show it to be an effective treatment. Biogen was planning to sell Aduhelm for $55,000 for a year’s dosage.

Patent Monopolies Encourage Secrecy

The quest for monopoly control over a new drug or technology encourages secrecy in research. A drug company wants to maximize its ability to gain the fruits of its research spending and minimize the extent to which competitors can benefit. For this reason, they are likely to closely guard their research findings and limit the ability of researchers to share information by requiring them to sign non-disclosure agreements.

Such secrecy almost certainly impedes the development of technology, since science advances most rapidly when research is freely shared. The Human Genome Project provided a great example of such sharing, where the Bermuda Principles required that results be posted on the web as quickly as possible.

If we relied on direct public funding for research, expanding on the $50 billion a year we now spend through NIH and other government agencies, we could impose comparable rules, requiring that all research findings be quickly available on the web. This would allow researchers everywhere to quickly benefit from any breakthroughs. It would also steer them off dead ends uncovered by other researchers.

In addition, if the focus is public health rather than finding a patentable product, this route of direct funding would also encourage research into dietary or environmental factors that could have a large impact on health. The patent system provides no incentive to research these issues.

Serious Discussion Requires Recognizing that Patents Are Not the Free Market

Our system for developing new drugs is a disaster. While we can point to great successes, these come at enormous cost. We will spend over $600 billion this year on prescription and non-prescription drugs. This comes to almost $5,000 per family. This is real money.

We would almost certainly be spending less than $100 billion if these drugs were sold in a free market without patent monopolies or related protections. And, even when people get third parties, either private insurers or the government, to pick up the tab, the high price requires them to jump through all sorts of hoops to get the necessary approvals. This sort of bureaucratic nonsense would be a pain for anyone, but it is especially hard on people in bad health.

It is much more difficult to have serious discussions of alternative systems if we work under the illusion that government-granted patent monopolies are somehow the free market. They are a government policy, just like direct funding of research would be a government policy. We need to have a serious debate of which policy provides the best mechanism for supporting the development of new drugs, and not be saying nonsense things about interfering with the market determination of outcomes. (I discuss this issue in chapter 5 of Rigged [it’s free].)

It is amazing how ideology can be so thick that it prevents even highly educated people from thinking clearly. We saw this fact on display in a Washington Post piece on prescription drug prices by its columnist Bina Venkataraman.

Venkataraman points out that we are seeing great advances in developing new drugs and treatments, but many of these innovations are selling for ridiculous prices. Her lead example is Casgevy, a treatment that can cure sickle cell anemia. The developer of this treatment is charging $2.2 million for it.

She argues that the price could be radically reduced if the research was funded at least in part by non-profits, governments, or companies willing to accept lower rates of return. This is of course true, but her ideology prevents her from seeing clearly the issues involved.

After arguing for developing drugs in ways that allow for lower prices, she asserts in the last paragraph:

“But there are steep costs to letting the market determine what’s best for a society’s well-being.”

The whole point here is that we are not letting the market determine what’s best for a society’s well-being. We, or our politicians, have decided that they want to grant lengthy and strong patent monopolies as a way to encourage companies to innovate.

This is not just a point of semantics. Granting patent monopolies is a policy choice, it is not a natural feature of the market. These monopolies are a way that the government has chosen to finance innovation. If we argue against patent monopolies, we are not arguing against letting the market decide how resources should be allocated, we are arguing against using this specific government mechanism for determining the way resources are allocated.

There is a very good argument against the patent monopoly system for financing prescription drug development. The obvious one, as Venkataraman points out, is that these monopolies can lead to ridiculously high prices for drugs and treatments.

This is for the obvious reason that people with the resources, either their own money or access to good insurance, are willing to pay huge amounts to preserve their health or save their life. But these high prices are almost entirely due to the patent monopoly. Water is also necessary for our life and health, but it is usually reasonably cheap, since there are not monopolies on it.

In the case of prescription drugs, it is almost always cheap to manufacture and distribute them. In a free market, they would generally sell for less than ten percent of the price of drugs subject to patent monopolies and often less than one percent. It generally would not be a major problem to pay for drugs, if they were available in a free market without patent monopolies.

While the world’s poor would find even generic prices expensive, if drugs were sold at free market prices, aid agencies and private charities could realistically look to cover the cost, as has been the case with AIDS drugs in Sub-Saharan Africa. In some cases, as with Casgevy, the price involves paying trained medical professionals to provide a treatment. This is a cost that would still be faced even without the patent monopolies, but the expense would be far more manageable.

Patent Monopolies Provide Incentives to Lie

When drug companies can sell their products for mark-ups of several hundred percent, or even several thousand percent, they have enormous incentive to push their drugs as widely as possible. This means exaggerating the potential benefits and also minimizing the side effects and risks associated with their drugs.

The extreme case of this lying was the opioid crisis, where drug manufacturers knew that their drugs were highly addictive and pushed them with the claim that they were not. This led to far more abuse, which ruined the lives of hundreds of thousands of people.

While opioids are an extreme case, drug companies routinely pay doctors to promote their products and lobby politicians and government agencies to have their drugs used as widely as possible. To take a prominent recent example, through intensive lobbying Biogen got the FDA to approve its Alzheimer’s drug Aduhelm, over the objections of its independent advisory panel.

The drug’s trials showed little evidence of effectiveness and serious side effects. The decision was later reversed. If Aduhelm was being sold as a low-cost generic, there would have been little incentive to push a drug in a situation where the evidence did not show it to be an effective treatment. Biogen was planning to sell Aduhelm for $55,000 for a year’s dosage.

Patent Monopolies Encourage Secrecy

The quest for monopoly control over a new drug or technology encourages secrecy in research. A drug company wants to maximize its ability to gain the fruits of its research spending and minimize the extent to which competitors can benefit. For this reason, they are likely to closely guard their research findings and limit the ability of researchers to share information by requiring them to sign non-disclosure agreements.

Such secrecy almost certainly impedes the development of technology, since science advances most rapidly when research is freely shared. The Human Genome Project provided a great example of such sharing, where the Bermuda Principles required that results be posted on the web as quickly as possible.

If we relied on direct public funding for research, expanding on the $50 billion a year we now spend through NIH and other government agencies, we could impose comparable rules, requiring that all research findings be quickly available on the web. This would allow researchers everywhere to quickly benefit from any breakthroughs. It would also steer them off dead ends uncovered by other researchers.

In addition, if the focus is public health rather than finding a patentable product, this route of direct funding would also encourage research into dietary or environmental factors that could have a large impact on health. The patent system provides no incentive to research these issues.

Serious Discussion Requires Recognizing that Patents Are Not the Free Market

Our system for developing new drugs is a disaster. While we can point to great successes, these come at enormous cost. We will spend over $600 billion this year on prescription and non-prescription drugs. This comes to almost $5,000 per family. This is real money.

We would almost certainly be spending less than $100 billion if these drugs were sold in a free market without patent monopolies or related protections. And, even when people get third parties, either private insurers or the government, to pick up the tab, the high price requires them to jump through all sorts of hoops to get the necessary approvals. This sort of bureaucratic nonsense would be a pain for anyone, but it is especially hard on people in bad health.

It is much more difficult to have serious discussions of alternative systems if we work under the illusion that government-granted patent monopolies are somehow the free market. They are a government policy, just like direct funding of research would be a government policy. We need to have a serious debate of which policy provides the best mechanism for supporting the development of new drugs, and not be saying nonsense things about interfering with the market determination of outcomes. (I discuss this issue in chapter 5 of Rigged [it’s free].)

Read More Leer más Join the discussion Participa en la discusión

We all know the old line about intellectuals having a hard time dealing with new ideas. The New York Times set out to prove this point with a column by Kim Scott warning that Spotify may do to the book industry what it has already done to the music industry. The main concern in the piece is that Spotify is getting into the business of pushing audiobooks. The piece argues that it will control the pricing and the publicizing of books in ways that disadvantage authors. The piece is fighting an imaginary foe.

I don’t have any interest in defending monopolistic corporations, and arguably Spotify fits the bill here, but the idea that it is the main problem facing musicians, or possibly authors in the future, is complete nonsense to anyone who follows Scott’s argument.

To see this point just follow the links in the piece claiming that Spotify impoverishes musicians. We learn from one that Spotify keeps roughly 30 cents of each dollar that people pay to hear streaming music. The other piece tells us that just 13,400 musicians or songwriters (0.2 percent of the total) make over $50,000 a year from their sales on Spotify. Only 7,800 earn over $100,000 a year.

If we think that $50,000 is a minimum that a musician can pocket from recorded music to make a decent living along with what they can get from live performances, that means that not many musicians will be able to support themselves without a day job. The number is cut almost in half if we use $100,000 as a cutoff. That would be a bit more comfortable, but hardly a lavish standard of living. (Supreme Court Justice Clarence Thomas apparently thinks that $285,000 a year is poverty.)

In short, given the current economy of the music industry, very few people can make a living writing and performing music. And Scott warns us that writers will face a similar fate once Spotify ramps up its audiobook marketing.

There is little reason to doubt the numbers Scott gives us, but is Spotify really the villain here? The company pockets 30 cents of every dollar that it pulls in. Maybe that is too much, but suppose it was reduced to 15 cents of every dollar, thereby increasing the take of the musicians by 20 percent. Would this picture look very different? And Spotify is actually losing money at present, so it is not clear that it has a hugely excessive margin.

Is there a plausible story that there would be more money in streaming if we didn’t have Spotify? That seems unlikely. As a company with considerable marketing power, its incentive is to maximize revenue. Many businesses are run poorly, and Spotify may be one of them, but it is hard to believe that it is so badly mispricing its music that it is missing out on a great deal of revenue that would be available with a better strategy.

It’s also worth remembering the environment that gave birth to Spotify. Napster and other services that allowed unauthorized copies to be downloaded at no cost were proliferating on the web. The idea of Spotify was that it would allow people to get music easily and at low cost in a way that at least paid the performing artists something. If we envision a world where there is not a low-cost service like Spotify, it is almost certainly one where there are many more Napsters.

Apart from the size of the total pie, there is a question of whether Spotify is responsible for its concentration in a relatively small number of performers. The distribution of revenue among musicians, writers, actors, and other creative workers has always been highly skewed towards a small number of stars. Perhaps Spotify makes this worse, but it is not clear how. In any case, even if we divided Spotify’s total $7 billion take completely evenly, and we didn’t have the service pulling out anything for operating costs and profits, it would only allow 140,000 people to earn $50k a year from their music.

That would be a bit more than ten times as many as now, but it still would only be a small fraction of the people looking to make their living in the music industry. It obviously does cost something to run a worldwide streaming service, so even if we think Spotify’s 30 percent cut is too high, we are not going to be able to push it anywhere close to zero. And the Bruce Springsteens of the world are not likely to be satisfied getting just $50k a year from their recordings.

In short, if we think there is a big problem with musicians being unable to support themselves, and writers are soon to be in the same boat, the issue is not Spotify. The problem is not enough money being spent on creative work.

Getting More Money to Creative Workers

At the most basic level, we are paying out much less money for creative work now than in prior decades because so much is now available at zero cost over the Internet. To take the case of recorded music, where the drop-off is most pronounced, going back to the start of the century in 2000, the early days of the Internet, we spent roughly 0.19 percent of GDP on recorded music. That would be the equivalent of $51 billion a year in today’s economy. Instead, we spend just $14 billion on streaming services, permanent downloads, CDs, and records, just over one fourth as much measured as a share of GDP.

Part of this falloff is due to savings on the physical product, since only a fifth of the current spending is going to purchase CDs or records, whereas in 2000 all of it was. However, that can only explain a small portion of the decline, the rest is due to less money going to the people who write and perform music. There is a similar story with newspapers, books, movies, and other types of creative work. With less money being spent, there is less money being paid to creative workers. We can devote our efforts to fighting over a diminishing pie, or we can try to develop ways to expand the size of the pie.

The latter would mean relying on a new mechanism for supporting creative work and creative workers. Currently, we rely primarily on government-granted copyright monopolies for getting money to creative workers. The logic is that the government gives this monopoly as a reward for creative work. However, it is worth much less in the Internet Age, both because there is competition from a large amount of material that is available at zero cost and because copyrights are more difficult to enforce.

Congress did pass the Digital Millennial Copyright Act in 1998 to ensure that copyrights could be enforced on the web, but even with this very copyright-friendly law, there are literally billions of unauthorized downloads of songs, movies, and TV shows every year. Granting copyright monopolies may have been a useful policy for supporting creative work a hundred years ago, but in the Internet Age it clearly is not an efficient route.

It is long past time that we talked about alternative mechanisms for supporting creative work. My preferred mechanism is an individual tax credit, modeled on the tax deduction for charitable contributions. (I outline this system in a bit more detail in chapter 5 of Rigged [it’s free].) The basic logic is that every person could get a tax credit, say $100 to $200, to support the creative worker(s) of their choice. This credit could go to a single writer, musician, singer, or other performing artist, or an organization that supports creative workers, say focused on country music or mystery writers.

Unlike the charitable contribution tax deduction, this would be a credit that would have the same value for everyone. It also would be fully refundable, so that even people who owed no taxes would be able to use it.

On the receiving side, individual creative workers or organizations would register with the I.R.S. or a new agency, indicating what creative work they do. This registration would be similar to what groups do now to get tax-exempt status. The organization must indicate what it does to qualify for tax-exempt status, for example, is it a church, a charity that provides healthcare to the poor, or a cultural institution? The I.R.S. doesn’t attempt to evaluate its quality as a church or cultural institution, just that the organization does what it claims.

One condition of getting the money through this system is that the people getting funding through the tax credit system would not be eligible for copyright protection for a substantial period of time after getting the money. The idea is that the public has already paid for your work, it should not have to pay a second time. Any material produced through this system should be freely available on the web.

A nice feature of this provision is that it is self-enforcing. If someone gets money through the tax credit system and then copyrights their work, they would find that their copyright is unenforceable. If they tried to sue for infringement, the defendant could just point out that the person was in the tax credit system, and therefore ineligible for copyright protection.

There are efforts in Seattle and Washington, DC to set up systems along these lines to support local journalism. If either gets implemented, it will provide a useful test of this sort of alternative mechanism for supporting creative work.

Can Intellectuals Consider New Ideas?