October 27, 2012

The NYT badly misinterpreted data suggesting that household debt may soon be rising again. The NYT noted the fact that households may be taking on debt again on net and argued that this may presage an uptick in the economy. In fact, it suggests nothing of the sort.

At any point in time tens of millions of households are taking on new debt by buying homes, taking out student loans, borrowing against a credit card or taking out other loans. At the same time, tens of millions of families are reducing their debt, most importantly by paying down mortgages. In addition, much debt is being eliminated as a result of being written off by creditors, mostly through bankruptcy or foreclosure.

The reason that debt has been falling in the last few years has been due to the large amount of debt being written off, primarily as a result of foreclosures. To get an idea of this magnitude, suppose that 1 million homes a year go through the foreclosure process. If we assume an average mortgage of $200,000 a home (roughly the magnitudes involved), this would imply the elimination of $200 billion in debt each year, assuming that the households taking on new debt were just balanced by the households paying off debt. If the number of foreclosures fell in half to 500,000, and nothing else changed, then the rate at which debt was being reduced would fall to $100 billion a year.

This is primarily the story that we are seeing as the pace of debt reduction slows and is possibly reversed. The number of foreclosures is gradually falling, meaning that the pace of debt elimination through this channel is slowing, however this has little direct impact on the economy. (The foreclosure process does employ people and generate incomes.)

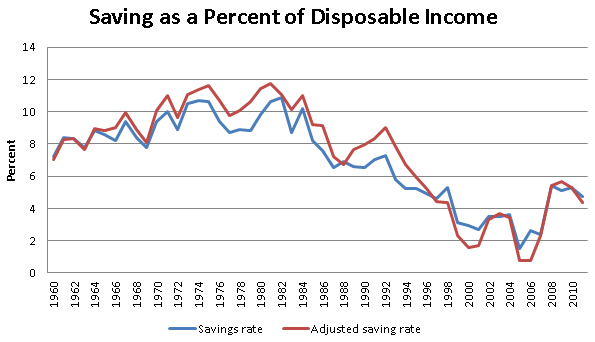

The relevant issue for the economy is the saving rate. While the saving rate is above its near zero level at the peak of the bubble, it has been below its long-term average throughout the downturn. (The adjusted saving rate is a nerd issue having to do with the statistical discrepancy in the national accounts.)

Source: Bureau of Economic Analysis.

Source: Bureau of Economic Analysis.

The 3.7 percent rate for the third quarter is well below the pre-bubble average of more than 8.0 percent. It would be surprising if the saving rate would fall still lower since most households have very little wealth saved for retirement and the leadership of both parties is proposing cuts in Social Security and Medicare. In short, there is no reason to expect that an upturn in consumption will provide a boost to the economy.

Comments